How to Prepare for a Nonprofit Audit: 4 Essential Steps

If your nonprofit is considering conducting an audit, you might feel intimidated or worried, especially if it’s your first time. However, audits are a crucial part of effectively managing your organization’s finances, ensuring proper governance, and maintaining transparency with stakeholders. And once you understand the process, it isn’t nearly as scary as it may seem!

Most nonprofits hire external professionals to conduct audits, but that doesn’t mean your team should contact the first auditor you find and leave everything in their hands. Rather, proper internal preparation helps ensure your audit is accurate, timely, and useful for shaping your organization’s financial practices going forward.

In this guide, we’ll walk through four steps your nonprofit should take to get ready for its audit and lay the foundation for receiving thorough, actionable results. Let’s dive in!

1. Decide What Type of Audit You Need to Conduct

While the term “audit” is most often used in financial contexts, not every nonprofit audit focuses on finances. Different types of audits serve different purposes, and the right one for your nonprofit depends on your unique needs, goals, and priorities.

According to Jitasa’s nonprofit audit guide, the most common audit categories are as follows:

- Independent financial audit. This type of audit occurs when a third-party auditor reviews your financial data, documentation, policies, and procedures to provide an expert, objective perspective on your nonprofit’s health and compliance.

- Internal financial audit. This audit is similar to the independent financial type, except your nonprofit’s employees are the ones reviewing its financial information. Although these audits can’t be completely objective, they give your team a chance to think critically about your organization’s financial situation.

- IRS financial audit. The IRS doesn’t audit tax-exempt organizations often, but if your nonprofit fails to file its annual tax return or a discrepancy is discovered, a government agent may come calling.

- Compliance audit. These audits assess your organization’s adherence to internal (i.e., bylaws and policies) and external guidelines (i.e., federal, state, and local government regulations). Financial compliance is part of this audit, but it also touches other areas of your organization, such as fundraising and administrative compliance.

- Operational audit. This category of audits involves analyzing processes and systems to identify ways to improve efficiency and effectiveness. They can be general or focused on one area of your operations like technology or human resources.

For the purposes of this article, we’ll focus primarily on independent financial audits since they’re the most common type of nonprofit audit. They’re also the most likely type of audit to be required for your organization, whether because of a stipulation in your bylaws, a federal or state government regulation, or a request from the funder of a grant you’re pursuing.

2. Lay out Your Auditing Timeline

The entire independent financial audit process takes several months to complete. If you have a deadline to submit your audit report to a grantmaker or government agency, note that date and work backward to figure out when you need to begin, building in some wiggle room to ensure you finish in time.

Here is a quick breakdown of the phases of the audit process and how long each one typically takes:

- Selecting an auditor: 4-12 weeks

- Preparing for the audit: 2-4 weeks

- Conducting the audit: 2-4 weeks

- Implementing audit recommendations: No specific timeline, but the sooner you can start, the better!

If your nonprofit doesn’t have an external deadline for your audit, try to conduct it and begin implementing the recommendations before completing your annual tax return. This way, you can let the IRS know that you’re actively improving your processes, and your team won’t have to work on two major financial projects at the same time.

The Form 990 filing deadline is the 15th day of the fifth month after the end of your nonprofit’s fiscal year (May 15 for organizations whose fiscal year follows the calendar year). You can extend the due date by up to six months if needed to conduct your audit—you’ll just have to file Form 8868 and get approval from the IRS to make the extension official.

3. Select a Nonprofit Auditor

Choosing your auditor typically takes longer than any other step in the independent auditing process. It’s important to select an individual or firm that can meet your needs and goals while working within your budget and timeline.

Here is a basic overview of how to find the right auditor for your nonprofit:

- Conduct online research, making sure to read reviews from each candidate’s past clients and noting their pricing structure.

- Ask for recommendations from other nonprofits in your network that have undergone financial audits and from your organization’s accountant (who typically won’t conduct your audit to avoid a conflict of interest, but likely knows of auditors who can).

- Issue a Request for Proposals (RFP), which Cornershop Creative describes as “a formal document that outlines the requirements, specifications, and criteria of a project or service [and] serves as an invitation for qualified vendors or partners to submit bids.”

- Meet with your top candidates after reviewing their proposals to compare costs, timelines, and scope of work so you can make an informed final decision and send your chosen auditor an accurate contract.

Just like with hiring financial team members for your organization, look for auditors who specialize in working with nonprofits. When searching online, use keywords like “nonprofit auditing firms near me” or “nonprofit auditors in [city name]” to narrow your results. Additionally, make sure their past clients include nonprofits of approximately the same size as yours to ensure they’re familiar with similar financial situations.

4. Organize Your Financial Records & Reports

After signing your contract and scheduling your audit, your auditor will send over a Provided by Client (PBC) list. This list details all of the documents they’ll need to complete their review, which can range from your fiscal policy handbook to financial statements to board meeting minutes. Compile these resources in a digital folder that you can share with your auditor for easy access.

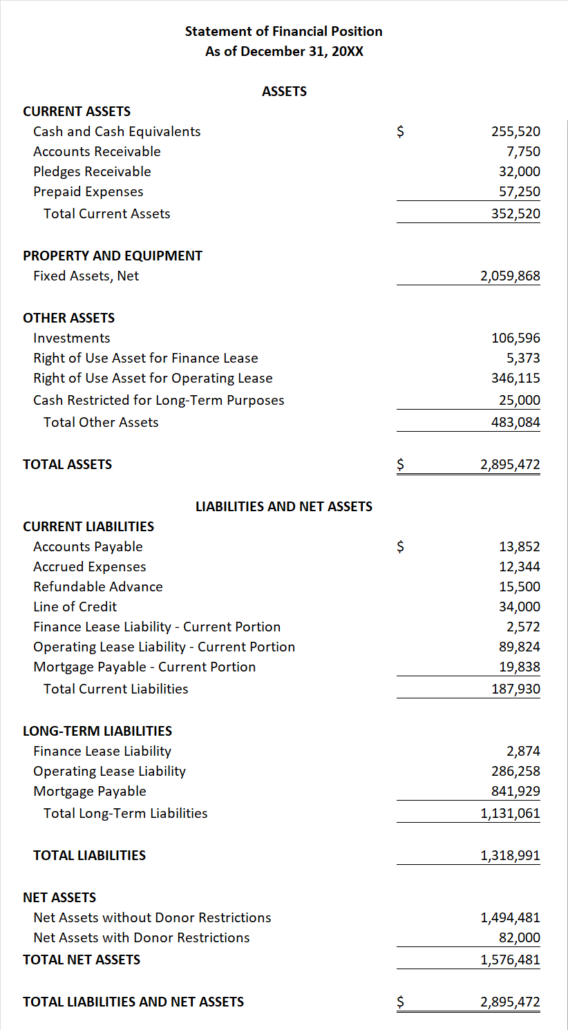

However, pulling together everything on the PBC list is only part of the audit prep equation. You also have to clean up your accounting system—not only to help your auditor find the information they need in it, but also to demonstrate that you’re practicing good financial data hygiene, which the auditor will be looking for as they assess your procedures.

Before your audit, make sure to:

- Reconcile all bank and investment accounts

- Ensure restricted funds and assets are properly tracked

- Resolve any uncategorized or uncleared transactions

- Deposit any undeposited funds

- Review receivables and payables

- Identify and fix coding errors (e.g., duplicated or inconsistent entries)

If you need help with these tasks, your bookkeeper or accountant can help you identify and resolve any issues in your accounting system before the audit begins and pull any reports you might still need for your PBC folder.

Even if you prepare thoroughly for your audit, your report might not be perfect, which is completely fine! Remember that your auditor isn’t just there to check boxes. They can be a valuable partner in helping your organization develop sustainable practices for long-term financial success.

When you get your report, take some time to review the recommendations with your team and determine the best ways to incorporate them into your financial management activities. Then, hopefully, your next audit can go even more smoothly!