Why Companies Should Have Employee Giving Programs

Businesses that give back to their communities receive a number of benefits in return. From improved reputations to higher employee retention, corporate philanthropy is only increasing in importance in the for-profit sector and for good reason.

Corporate giving takes many forms, and one method in particular allows businesses to make an impact and engage employees at the same time: employee giving programs. Workplace-based giving initiatives provide employees with the opportunity to make a difference with their own two hands.

In this post, we will discuss the benefits of employee giving programs and provide examples of companies that have successfully implemented such programs. Specifically, we’ll explore:

- What are the benefits of employee giving programs?

- Type of Corporate Giving Programs

- How to Implement an Employee Giving Program

Whether you want to update your current employee giving strategy or launch an entirely new program, this guide will provide answers to what makes employee giving so effective.

What are the benefits of employee giving programs?

Employee giving programs provide numerous benefits for both employees and the companies that implement them. Some of the key advantages of these programs include:

Improved Employee Engagement and Morale

Employees who can support causes they care about through their workplace are more likely to be engaged and motivated in their jobs. After all, they know their hard work is helping to support a good cause.

Studies have shown that employees who are engaged in their work are more productive, have higher job satisfaction, and are less likely to leave their jobs. In addition, employees who can give back to their communities through their workplace are more likely to have a positive attitude and feel a sense of purpose in their work. Let’s look at some specific statistics:

- Engaged employees make fewer mistakes, resulting in 64% fewer safety incidents.

- Studies have found that highly engaged teams have 14% higher productivity.

- CSR programs have been linked to increased employee engagement, improved productivity, and even reduced turnover by as much as 50%.

- 86% of employees want the opportunity to participate in corporate giving.

- Businesses with engaged employees report 50% less absenteeism.

Companies with employee giving programs are also more likely to attract and retain top talent. Many job seekers today are looking for companies that align with their values and support charitable causes, and having an employee giving program can be a key differentiator in the job market.

Boosted Reputation

Companies that practice corporate social responsibility (CSR) are generally looked upon favorably by consumers and employees alike. As discussed, employees want to work for employers they know are making a positive impact in the world, and consumers also want their hard-earned dollars to support businesses making a positive impact.

All types of corporate philanthropy can lead to a positive reputation boost. For example, sponsorships, match grants, and in-kind donations can all help worthy causes. However, employee giving programs specifically give employees more control over which organizations receive funding, increasing their stake in the business’s CSR practices.

In addition to making financial contributions, employee giving programs can also provide opportunities for employees to volunteer their time and skills to support charitable organizations. This is why some law firms require lawyers to work a certain amount of pro-bono hours each year.

Although, take care in whether employees are invited to participate in employee giving or are forced to. While optional programs are likely to see less participation, required ones can lead to resentment from employees, especially if they have limited say in which causes they can give to.

For an example of how to offer freedom of choice in an employee giving program, many companies offer matching donations or volunteer grants. Within these programs, the company matches its employees’ gifts or donates based on the hours its employees spend volunteering. The employees decide which organizations they want to support, and their employer follows suit by giving to the causes they’ve signaled they care about.

Tax benefits

CSR programs allow businesses to do good in the world. Of course, businesses are also fundamentally for-profit organizations, and saving a bit of extra money due to their philanthropic actions is often a major motivator behind giving programs.

Here’s a rundown of how employee giving programs provide tax benefits for both companies and their employees:

- For companies, workplace giving programs can be a tax-deductible expense, reducing tax liability. In addition, many companies offer matching donations or volunteer grants as part of their employee giving programs, and these contributions can also be tax-deductible.

- For employees, individuals who make charitable contributions through payroll deductions or donate as part of a matching gift program can claim these deductions on their tax returns. In-kind donations employees make by volunteering their professional services can also sometimes be claimed as a deduction. Work with employees to help them estimate the value of their in-kind donations and make accurate statements on their taxes.

As part of your business’s corporate giving strategy, keep careful records of your donations. Request donation receipts from your nonprofit partners if they are not already providing them, and ensure the details of sponsorships and other partnership arrangements are written down and confirmed by both your business and the nonprofits you work with.

Types of Corporate Giving Programs

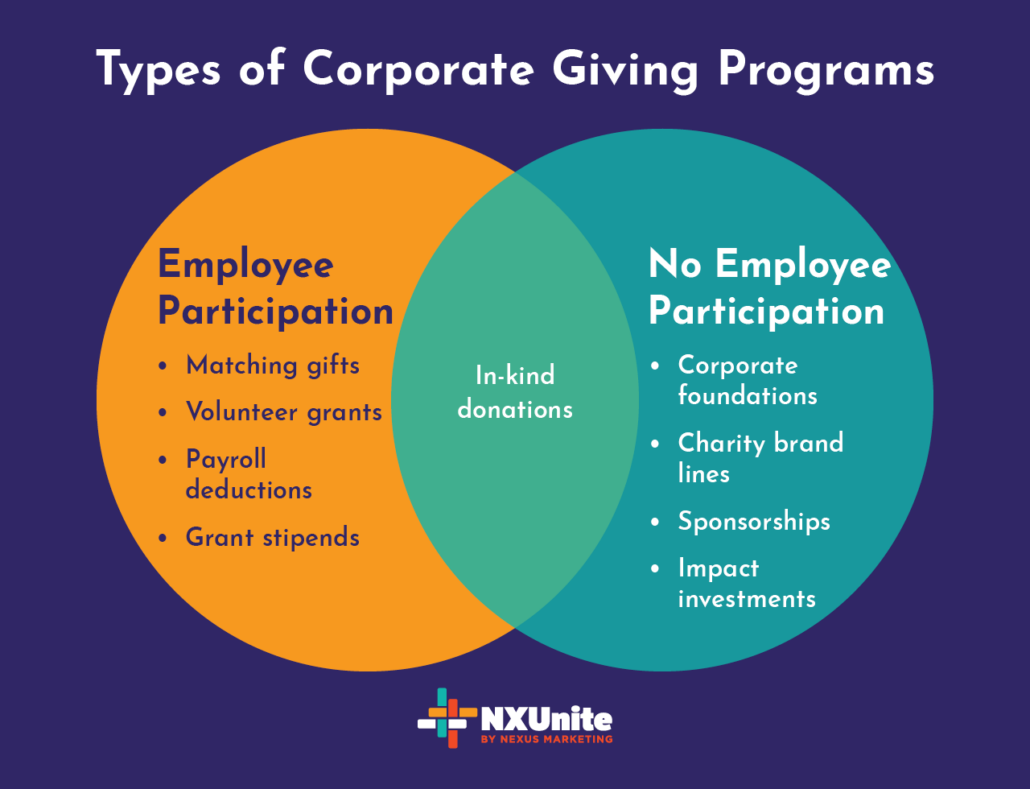

Corporate giving takes many forms, some of which include employee involvement. Most businesses that are serious about CSR will have a mix of philanthropic programs to meet their communities’ needs and be responsible corporate citizens.

Let’s take a look first at corporate giving programs that have an element of employee giving:

- Matching gift programs allow employees to give more to the causes they care about. In a matching gift program, an employee donates to a nonprofit of their choice. Then, they submit a matching gift request to their employer reporting the donation. If the application is approved, the employer makes an equal contribution to the nonprofit. At a few exceptional companies, they’ll even donate double or triple the employee’s initial gift.

- Volunteer grant programs allow employees to lend their time to the causes they care about and contribute financially through their employer. Essentially, employees volunteer and then report their hours and any other necessary details, like the nonprofit’s tax ID, to their employer. The business then makes a donation either on a per-hour basis or after a certain hours threshold has been reached.

- Payroll deductions are the most convenient type of employee giving. Employees agree to be part of an automatic deduction program and have a portion of all future paychecks donated to a nonprofit unless they later ask to opt out of the program.

- Grant stipends differ from matching gifts and payroll deductions by providing employees with the money to donate instead of asking them to reach into their wallets. Businesses provide funds specifically to be donated, and employees then give them to a cause of their choice.

These programs engage employees and let them have an active say in what causes are supported. Of course, there are many other worthwhile corporate giving opportunities unrelated to employees that a company might pursue. These include:

- Corporate foundations are charitable organizations that are established, managed, and funded by companies. Essentially, these foundations are nonprofit organizations with corporate backing. Some provide grants to nonprofits, while others plan and launch their own mission-based initiatives. As an example, The Ben & Jerry’s Foundation is managed by Ben & Jerry’s and awards grants to advocacy groups.

- Charity brand lines are a form of sponsorship wherein a company works with a nonprofit to develop a specific product or service and pledges to donate a portion of sales proceeds to the nonprofit. Shop-for-a-cause programs like this focus simultaneously on helping nonprofits and driving sales since socially conscious consumers are more likely to buy a product if they know it supports a good cause.

- Sponsorships involve companies providing support to nonprofit events, programs, or initiatives. This support can be financial gifts, in-kind donations, or marketing assistance. Sponsorships can also be one-time deals or ongoing partnerships based on the agreement between the nonprofit and the corporation.

- Impact investments are a process wherein companies invest in nonprofits or socially responsible for-profit organizations. The investment funds provide support for the organizations to get their programs off the ground, and the company generates a financial return.

Last, there’s one type of corporate giving program that fits in the middle of this venn diagram:

- In-kind donations can involve employees or be entirely managed by the company. For example, mission-driven businesses that provide software nonprofits use often have free or discounted subscription options for nonprofits. This form of corporate philanthropy does not involve employee giving at all. However, in-kind donations also include professional services, like consulting, accounting, photography, graphic design, and coding all rely on volunteers, which will be the business’s employees.

Which type of corporate giving is right for your company? The answer depends on numerous factors, such as employee interest, which nonprofits are interested in working with your business, and what resources you have available to spend on philanthropy.

However, if we had to pick a favorite, we would single out matching gifts as the best type of employee giving program.

An In-Depth Look at Employee Matching Gifts

With over 26 million individuals working for companies that offer matching gift programs, employee matching gifts have the capacity to make a major impact. For your program, determine what causes you want to support through matching gifts, which of your employees are eligible, and how much you intend to give.

For instance, one company might make only full-time employees eligible for matching gifts, but they may pledge to match all gifts at a 1:1 ratio with an annual cap of $10,000. In contrast, another company might open up its matching gift program to part-time and retired employees but enforce a narrower range of gifts between $50 to $2,500 and exempt donations to educational and religious institutions.

However you decide to organize your matching gift program, you can access benefits like:

- Flexibility. Depending on their employer’s restrictions, matching gift programs allow employees to decide which causes they want to give to, when they make their donations, and how much they give. While placing limits on your program can channel employees to support specific causes, keep in mind that as restrictions go up, participation goes down.

- Potential for automation. Matching gift technology is advancing fast, and businesses using CSR software with matching gift auto-submission technology can enable their employees to complete their matching gift requests in seconds. All they need to do is turn on the feature, and employees will get the option to have their request automated when they give to nonprofits with matching gift software.

- Easy management. Once you kick off your matching gift program, it essentially runs itself. Businesses just need to regularly take two actions. They need to approve matching gift requests and routinely promote the program to remind employees to participate.

Interested in what matching gift programs look like in action? Here’s how matching gift programs have played out at a few companies whose names you might recognize:

- Microsoft. Microsoft’s employee giving program, known as the Microsoft Employee Giving Program, encourages participation by having a donation minimum of just $1. Both full and part-time employees can participate, and almost every type of nonprofit organization is eligible for a matching gift.

- Coca-Cola. Most employers have a 1:1 matching gift rate, but Coca-Cola wants to make its employees’ donations go even further with a 2:1 rate, effectively tripling donations.

- Johnson & Johnson. Both current and former employees at Johnson & Johnson can increase their donations. Current full and part-time employees receive a 2:1 matching rate, while retirees still get a standard 1:1 ratio.

Overall, employee matching gift programs can provide numerous benefits for companies and their employees. By offering such a program as part of their employee giving programs, companies can increase the impact of their employees’ charitable giving and enhance their reputation as socially responsible organizations.

How to Implement an Employee Giving Program

The first step in implementing any CSR program is deciding that now is the right time. You have the resources, a philanthropic mission, and you’re pretty sure that your employees will be happy to participate. Now you just need to plan your implementation.

While details vary depending on your program of choice, here are the five steps most companies will take to launch their new employee giving program:

- Identify the causes that are most important to your employees. As the name implies, your employees drive your employee giving program, so make sure it’s focused on causes they want to support. Conduct a survey or hold focus groups to find out what causes are most important to your employees. If opinions are divided, consider a program like matching gifts allowing each employee to make their own giving decisions.

- Offer a range of giving options. There’s no need to limit yourself to just one type of employee giving. For instance, many companies that offer matching gift programs also support volunteer grants. Refer to the causes and types of activities employees indicated interest in from your initial survey.

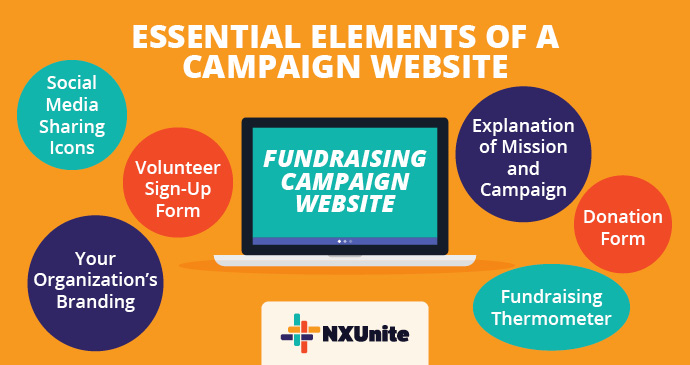

- Invest in the right CSR software. Choose a CSR platform with the tools you need to run your program. Most CSR software comes equipped with features to record employee volunteer hours, manage matching gifts, and provide employees with information about donating through your company. However, different vendors focus on different aspects of CSR, so be sure to research platforms and request demos before making any final purchasing decisions.

- Provide clear and concise information. To ensure that your employees understand your employee giving program and how to participate, provide clear and concise information about your new program. This includes providing guidelines on eligible charities, making donations, and claiming tax deductions. Make these resources easily accessible, such as adding them to your employee handbook.

- Promote the program to your employees. Some employee giving programs, like payroll deductions, require minimal active participation from employees. Others, like matching gifts, are entirely at employees’ discretion. Make sure employees know about your giving program by providing regular reminders and updates whenever you make a major difference for a nonprofit.

By following these steps, you can design and implement an employee giving program that engages your employees and supports the causes that they care about. This can help your company positively impact your community and enhance your reputation as a socially responsible organization.

Additional Employee Giving Resources

Employee giving programs provide numerous benefits for both employees and the companies that implement them. These programs can increase employee engagement and morale, help companies meet their CSR goals, enhance their reputations, and provide tax savings for both the company and its employees.

Of course, the CSR world is vast, and this overview is just one perspective. To learn more about employee giving before launching your own program, read a few of our favorite resources:

- How to Promote Matching Gifts: Reimagining Your Google Ads. Take your matching gifts program to the next level with Google Ad Grants. Discover how to use Google Ads and what they can do for your matching gift program and other CSR efforts.

- Corporate Giving Software: How to Choose the Best Solution. To start a new employee giving program, you’ll need corporate giving software. Learn how to assess potential platforms.

- How to Win At Corporate Philanthropy: A Nonprofit Guide. Get an in-depth look at corporate philanthropy from the nonprofit perspective with this guide.