Corporate Philanthropy – Nonprofit Catalog

Corporate philanthropy empowers charitable individuals to strengthen their impact on the causes they care about. Through corporate giving programs, businesses step up to the plate to provide nonprofits with the funding they need to thrive.

If engage with external partners at your nonprofit, you understand that corporate giving plays a major part in achieving your objectives. From your fundraising team to your volunteer team, it impacts every aspect of your operations.

If you’re not already leveraging these opportunities, you’re missing out on funding, volunteerism, marketing, and so much more. It’s never too late to start, though! We’ll take a look at the fundamentals of corporate philanthropy, starting with a basic definition.

What is Corporate Philanthropy?

Corporate philanthropy refers to the activities and investments that a company voluntarily offers to promote the welfare of society. Corporate giving often includes:

- Financial donations and grants

- Employee volunteerism

- In-kind services and products

By giving to charities, a company communicates its commitment to supporting the community that makes it profitable. To fulfill their social responsibility to support worthwhile causes, companies usually go beyond donating by offering employee programs like matching gifts and volunteer grants.

When developing these corporate giving programs, they usually outline participation guidelines, ensuring that participants and benefiting organizations align with the company’s values and objectives.

How Corporate Philanthropy Helps Nonprofits and Businesses

Engaging in corporate philanthropy has become standard for today’s businesses. These programs are wildly popular, because they benefit everyone involved. Here’s how these programs impact participating nonprofits and companies:

- Nonprofits can boost volunteers and donations. Corporate giving is also a fantastic marketing opportunity. When a nonprofit forms a partnership with a business, they can reel in new audiences with which they might not otherwise cross paths.

- Companies can generate positive brand awareness by attaching their names to charitable causes. They can also create a positive work environment where employees feel like their values are supported. By creating a culture of charitable giving, companies can empower employees to enrich society, directly impacting workplace satisfaction. In fact, Crowd101’s corporate giving statistics page estimates that employees who participate tend to have 75% longer tenures with their companies.

There’s really no downside to corporate giving! When chatting with a company’s leadership about forming a partnership, your nonprofit’s team can mention these advantages, positioning it as a mutually-beneficial opportunity.

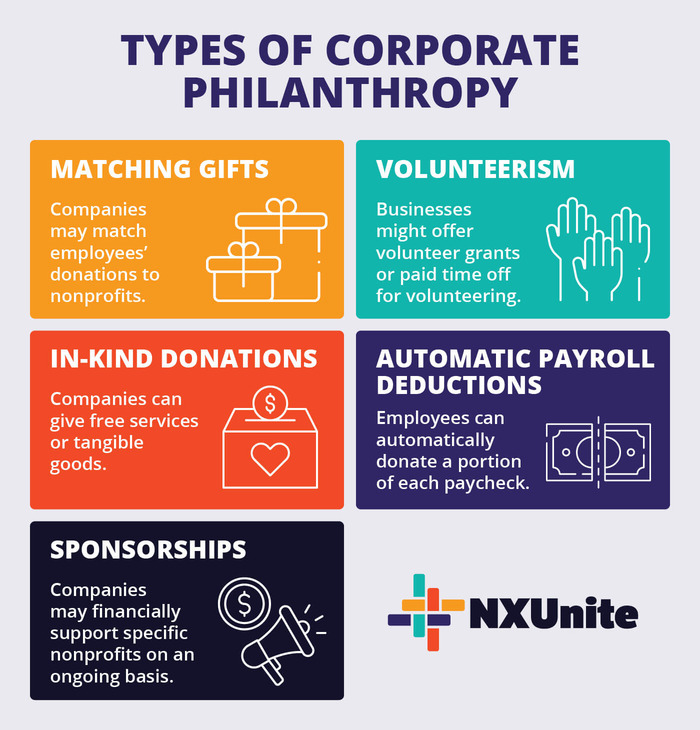

Types of Corporate Philanthropy

Corporate philanthropy takes several forms, and nonprofits need to be aware of these different types to fully leverage their potential. Let’s take a look at five ways companies can partake in corporate giving. Bear in mind that these aren’t the only types of corporate philanthropy — just the most popular ones.

1. Matching Gifts

Companies that offer matching donations will match their employees’ gifts to nonprofits. They usually offer these at a dollar-for-dollar rate, enabling employees to double their charitable contributions. However, some companies will offer them at higher rates, tripling and sometimes quadrupling the initial donation. Some companies will even match the money their employees raise through peer-to-peer fundraising!

Businesses usually set some ground rules for participating. Most often, guidelines include:

- Employee eligibility (e.g., full-time employees only)

- Nonprofit eligibility (e.g., no religious organizations)

- Match ratio (e.g., .5:1, 1:1, 2:1)

- Maximum and minimum donation amounts (e.g., gifts between $25-$1,000)

- Request deadlines (e.g., within one year of the original donation)

There’s a lot to keep up with when funneling donors through the match process. That’s why most nonprofits enlist the help of a matching gift tool. This allows the donor to research their company’s corporate giving guidelines, determine their eligibility, and learn how to submit a request.

Plus, a tool with autosubmission functionality will remove a few steps from the process, enabling donors to submit their match requests immediately from the donation confirmation page.

2. Volunteerism

Volunteering brings out the best in people. Volunteers can interact directly with nonprofits’ beneficiaries and can put their skills to use to drive societal change. Corporate volunteerism encourages employees to spend their time with their favorite organizations. It can take a few different forms, such as:

- Volunteer grants. With this type of corporate giving, companies promise to donate to the nonprofits where their employees regularly volunteer. Our volunteer grant guide explains that “some businesses pay per volunteer hour while others require employees to serve a minimum number of hours with an organization.” (Hint: board service usually counts toward volunteer hours!)

- Team volunteer grants. As a way to encourage team building, companies offer team volunteer grants. These programs are almost identical to volunteer grants, but usually have a few more requirements, such as how many employees must volunteer together.

- Volunteer time off (VTO). Some companies even offer paid time off for volunteering, allowing employees to take a few hours outside of the office to spend with a nonprofit and still get paid for the workday.

Volunteer-related corporate giving initiatives provide nonprofits with extra sets of hands, while employees exercise skills they can use both in and out of the workplace!

3. In-Kind Donations

In-kind gifts are contributions of goods or services, rather than financial donations. Occasionally, a company will offer in-kind donations as a way to support charity.

For instance, you might allocate $5,000 toward paying for graphic design services in your budget. A design firm may swoop in and donate free graphic design services to help your nonprofit out. This can free up some (or all) of that $5,000, so you can reallocate it toward other operational expenses.

In-kind donations can also take the form of tangible goods like prizes for charity auctions. Or, maybe companies will provide you with event space or catering. There are several ways a company can donate without writing a check!

Some companies even go as far as using a mission-driven business model in which they provide software and services exclusively to nonprofits. In this case, they may donate or offer their products or services at reduced rates.

4. Automatic Payroll Deductions

Automatic payroll deductions are one of the easiest corporate philanthropy initiatives. Employees can opt into their employers’ program and automatically send a portion of each paycheck to a specific nonprofit. The process is really similar to contributing to a retirement account.

Note that companies will usually limit the types of nonprofits that employees can send donations to through this program. Also, know that federal law requires charitable donations to come out of an individual’s post-tax earnings, so employees can deduct donations from their taxes each year.

5. Sponsorships

A sponsorship is an ongoing relationship between a nonprofit and a company. Double the Donation’s corporate sponsorships guide breaks this type of corporate philanthropy into a few groups, including:

- Financial: A company might sponsor a specific event or program, providing funding to make it possible.

- In-kind: This involves donating goods or services to the nonprofit, like we mentioned in the previous section.

- Media: A company might pay for a nonprofit’s advertising costs, such as those for televised commercials, radio promotions, and printed ads.

A key aspect of these relationships is that the nonprofit must acknowledge that the business has supported their programs or events. That way, the company receives positive publicity in exchange for their contributions.

How to Promote Corporate Philanthropy

Promoting corporate philanthropy to businesses and their employees can help your nonprofit secure meaningful support. Follow these tips to encourage widespread corporate giving:

- Build strong relationships with corporate partners. Reach out to businesses that align with your nonprofit’s mission and explain how starting a workplace giving program can be a mutually beneficial venture. For instance, you might say that their support will allow you to increase your programming by a certain percentage and, in turn, will help them achieve their corporate social responsibility (CSR) goals.

- Provide a variety of giving options. Offer a range of giving options to accommodate diverse employee preferences. This may include traditional payroll deductions, one-time donations, employer matching programs, or opportunities for employees to volunteer their time and skills. Make it convenient for employees to participate and choose the giving method that suits them best.

- Provide recognition. Recognize and celebrate corporate partners who participate in workplace giving programs to encourage their ongoing support. Acknowledge their contributions through newsletters, social media, and special events.

Be prepared to provide corporate partners with data and reports on the impact of their contributions. Demonstrating transparency and accountability in how you use their donations can strengthen the trust between your organizations.

Additional Resources

- Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

- Corporate Giving Programs: The Ultimate Fundraising Guide – Dive further into the world of corporate philanthropy and see some real-world examples in this guide.

- In-Kind Donations | Everything Your Nonprofit Should Know – In-kind goods and services can make it easier to achieve your mission. Learn everything you need to know about in-kind donations with this guide.