Payroll Giving Essentials FAQ: How Nonprofits Can Unlock Recurring Revenue

Is your organization fully utilizing the most reliable form of recurring revenue available? For many nonprofits and universities, the search for sustainable funding is a daily priority. Payroll giving offers a distinct solution by allowing your supporters to automate donations directly from their corporate paychecks, providing your nonprofit with a steady stream of unrestricted funds.

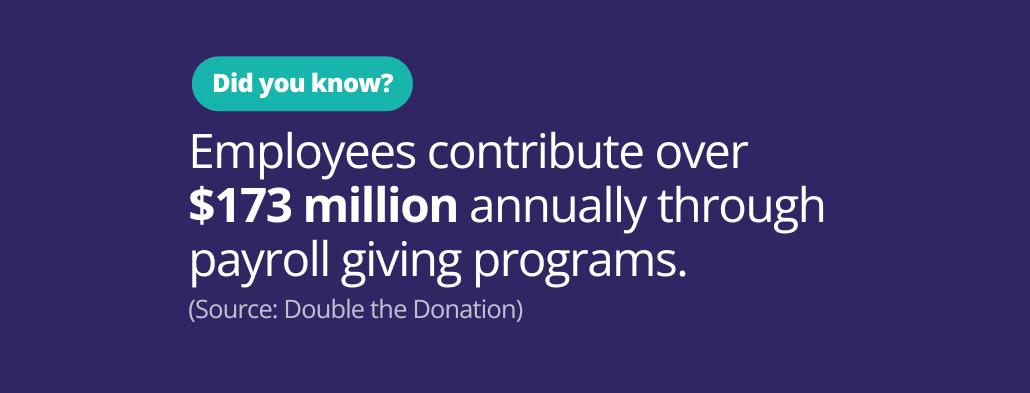

The potential here is massive, yet largely untapped. According to statistics gathered by Double the Donation, employees contribute over $173 million annually through payroll giving programs worldwide. However, a significant barrier remains: 59% of people have never heard of payroll giving. This lack of awareness presents both a challenge and an opportunity. While the revenue potential is high, supporters cannot sign up for programs they do not know exist.

In this guide, we will address the most common questions regarding workplace giving and how it functions alongside other corporate giving programs, like matching gifts. We will also examine how fundraising software can help you identify eligible donors, streamline the giving process, and ultimately increase the revenue necessary to support your mission.

1. What is payroll giving, and how does it benefit nonprofits?

Payroll giving allows employees to donate directly from their paycheck using automatic deductions set through their employer. Often, these programs are open choice programs, meaning that employees have the option to support any nonprofit or school of their choice through their payroll giving program. As a result, these programs provide sustainable funding opportunities for a large number of nonprofits.

While many companies promote payroll giving through their employee portal (commonly a workplace giving platform), many employees are unaware of the option, meaning that nonprofits miss out on potential revenue opportunities. To increase participation and benefit from these funds, nonprofits should educate supporters about payroll giving and encourage supporters to check their eligibility.

2. Why is payroll giving important for my nonprofit?

Payroll gifts often produce consistent revenue at scale because many donors prefer simple, recurring deductions, and if their employer offers one of these programs, this is an easy way for them to get involved. If you have a medium to large nonprofit, you will likely see strong results because of your larger supporter base. You can also benefit from higher brand awareness which encourages employees to enroll.

Payroll giving programs typically attract long-term donors who value easy automated contributions. Your nonprofit can support these donors by providing workplace giving information on your website and using fundraising tools to help donors confirm eligibility quickly.

3. What types of companies typically offer payroll giving programs?

Payroll giving has evolved into a benefit offered by businesses of all sizes, industries, and regions. Today, companies ranging from local mid-sized firms to global leaders in technology, finance, healthcare, and retail (such as Microsoft and The Home Depot) provide these programs to boost employee engagement. Some employers combine payroll giving with matching gift programs which doubles donor impact.

Because the opportunities are so widespread, the barrier to entry is not finding a company that offers it, but ensuring you are visible within their system.

Most of these companies use corporate social responsibility (CSR) platforms to process the deductions and distribute the funds. Therefore, a critical operational step for your team is to ensure your nonprofit is registered and capable of receiving electronic transfers (EFT) on these major platforms. If you are not in the system, a willing donor often cannot select you as a beneficiary.

Once you are registered, you can use a corporate giving database like Double the Donation to help your supporters identify their eligibility and guide them to the correct portal to set up their deduction.

4. How much revenue can payroll giving generate for my nonprofit?

Revenue varies widely depending on organization size and the number of your supporters that are eligible. However, many nonprofits see consistent monthly contributions that accumulate significantly across large donor bases.

Payroll gifts often remain active for years because deductions feel manageable for donors. This creates long-term revenue streams that support ongoing programs.

Your nonprofit can increase revenue by simplifying supporter discovery through payroll giving tools. Most nonprofits see meaningful results when payroll giving is promoted consistently.

5. How does payroll giving differ from traditional recurring donations?

To put simply, payroll giving happens through employer systems while recurring donations are set up directly through the nonprofit.

However, the most significant difference for the donor is the tax advantage. For payroll giving, donations are often deducted from an employee’s salary before tax is applied (pre-tax). This provides immediate tax relief for the donor, meaning it costs them less to give more. Because the funds are deducted before they ever hit the employee’s bank account, it simplifies financial planning and budgeting. Meanwhile, recurring gifts are typically paid from post-tax income, requiring the donor to claim tax deductions manually at the end of the year.

For the organization, the difference lies in retention. Traditional recurring gifts often churn due to expired credit cards or changed bank details. Payroll gifts, however, remain active as long as the employee stays with the company, providing a much more stable and long-term revenue stream. Additionally, because these gifts are routed through corporate systems, they are frequently bundled with matching gift opportunities, doubling the value of the donation automatically.

6. Are payroll giving donations tax deductible for employees?

Most payroll gifts are tax deductible because they are treated as charitable donations. Employees receive documentation through employer payroll systems, and this simplifies tax preparation for many donors.

While you do not need to issue separate receipts for payroll gifts, your nonprofit should still acknowledge gifts to support donor stewardship and engagement.

7. What challenges do nonprofits face when managing payroll giving?

The primary challenge is data inconsistency. Unlike recurring giving where you instantly receive the donor’s name, email, and amount, payroll giving funds are often disbursed through third-party corporate social responsibility (CSR) platforms that handle data very differently.

Nonprofits often face the “lump sum” reality, where they receive a single aggregate check for a certain amount that represents contributions from different employees, with little to no individual identifying information. This happens for two reasons: platform variance and privacy settings.

Every CSR platform has different reporting standards. Some provide detailed breakdowns, while others provide minimal aggregate data. Additionally, employees often have the option to give anonymously through their workplace portal, meaning the funds arrive without a name attached.

This lack of visibility makes donor stewardship incredibly difficult. If you cannot identify the individual behind the donation, you cannot thank them, which risks future retention.

To solve this, your nonprofit can use fundraising software to capture employment data. By using tools to identify where your supporters work (via search tools on your website or employer appends), you create a separate data stream. This allows you to identify potential payroll donors and steward them proactively.

8. How can my nonprofit know if a supporter is eligible for payroll giving?

Eligibility depends on employer benefit policies which vary widely across industries. Donors often do not know whether payroll giving exists at their company.

Your nonprofit can guide supporters by directing them to a payroll giving search tool. With a dedicated payroll giving plugin, you can help supporters confirm available programs quickly and give them a direct link to their next steps for payroll giving enrollment, while reducing staff workload and increasing overall participation.

9. How does my nonprofit get payroll giving funds?

Funds are usually distributed through workplace giving platforms on a scheduled basis, and payments may be bundled with other workplace donations.

With payroll giving, nonprofits receive aggregate transfers rather than individual donor payments. These transfers include basic remittance details which vary by platform. We recommend monitoring recurring reports to improve tracking and support accurate donor stewardship.

10. What misconceptions do nonprofits have about payroll giving?

Misconceptions often prevent nonprofits from pursuing payroll giving, causing them to leave significant revenue on the table. Here are the two most common myths and the data that debunks them:

- Myth #1: Payroll giving programs are uncommon and don’t generate much revenue. The Reality: Payroll giving is a significant source of funds across the globe. According to statistics gathered by Double the Donation, employees contribute over $173 million annually through payroll giving programs. This demonstrates the worldwide potential of payroll giving programs as a reliable revenue stream for nonprofits like yours. Far from being “niche,” thousands of employers, from the Fortune 500 to local businesses, also offer these programs as a standard benefit.

- Myth #2: Payroll giving requires a complex setup. The Reality: The technical setup is generally straightforward because the heavy lifting is done by the corporate CSR platforms. The real challenge is simply getting donors to notice it. This proves that the challenge and the opportunity is the lack of marketing and visibility of payroll giving programs.

It is also common for nonprofits to overlook payroll giving as a pipeline for matching gifts. By using a fundraising tool like Double the Donation, you can help supporters discover both opportunities easily. A clear promotion and marketing plan will help your nonprofit overcome these misconceptions.

Payroll Giving At A Glance

Implementing a strategy to capture payroll giving can help you secure immediate funds and build a foundation of financial stability for your organization. By understanding the mechanics of payroll match programs and utilizing the right fundraising software, you can transform sporadic donors into long-term partners in your mission.

We encourage you to audit your current donation forms to see if you are adequately capturing employment data. Small adjustments to your donor journey can reveal significant opportunities for workplace giving growth.

To learn more about payroll giving and other forms of workplace giving, explore more resources from Double the Donation and implement best practices, streamline processes, and capture more payroll gifts today.