Matching Gifts — Nonprofit Catalog

Companies everywhere are becoming increasingly aware of their responsibility to give back to their communities. To fulfill this obligation and support charitable causes, they develop corporate giving initiatives like matching gift programs.

Donation matching has the power to multiply the contributions you’re already receiving from donors. And when your donors are properly educated about the opportunity, they’ll be much more inclined to give.

If this is your first time hearing about matching gifts, don’t worry! It’s never too late to start leveraging corporate social responsibility (CSR) in your fundraising efforts. So that you can pinpoint opportunities within your donor database, we’ll cover the basics in this quick guide to corporate matching gifts.

What Are Matching Gifts?

Matching gifts are a type of corporate giving in which companies financially match the donations their employees give to nonprofits. Companies create guidelines to define which types of employees are eligible, which nonprofits are eligible, and how much someone must donate to qualify. This ensures that the program generates value for the company and participating nonprofits.

Companies most often match donations at a 1:1 ratio, meaning that they will donate $1 for every $1 an employee donates. However, some businesses will match at a 2:1 or 3:1 ratio, meaning some employees can effectively quadruple their donations to charity.

Benefits of Corporate Matching Gifts

At its core, matching gifts provide free money to nonprofits. Dive a bit deeper, and you’ll see that the benefits go beyond this surface-level advantage though.

From the nonprofit perspective, matching gifts can increase donor engagement and retention. Donors will feel like their contributions are making more of a difference in your cause without having to reach back into their wallets. Double the Donation’s nonprofit fundraising statistics page also claims that 1 in 3 donors would give larger gifts if they knew their employer would match their gift.

A driving force for companies to create this type of program is that it can increase employee satisfaction. By supporting their donations, they’re showing employees that they care about their values outside of the workplace. And as we touched on earlier, giving to charity can also create positive brand recognition for companies. These benefits are great to communicate to company leadership if your nonprofit’s team ever encourages a local business to create a program.

Common Guidelines for Matching Gift Programs

When developing a matching gift program, corporations often lay out some basic participation guidelines. This makes it easier for them to match the donations that align with their organization’s values and priorities. Here are some of the most common rules corporations define:

- Matching gift ratio. This is the rate at which a company will match donations. Like we mentioned, this is most often a dollar-for-dollar rate.

- Minimum and maximum match amounts. This specifies the highest and lowest donations that a company will match. For example, a company might match gifts made between $25 and $1,000.

- Submission deadlines. Different companies have different deadlines by which a donor must submit a matching gift request. Common deadlines include the end of the calendar year, a set number of months after the donation, and within 12 months of the donation.

- Employee eligibility criteria. Some companies will outline which types of employees are eligible. This might include full-time employees, part-time employees, retirees, and even employees’ spouses.

- Nonprofit eligibility criteria. Crowd101’s corporate matching gifts guide explains that most nonprofits and public educational institutions are eligible. However, companies often exclude religious organizations from participating in their programs.

When you outsource the work to a matching gift tool, you’ll simplify the research process. You can easily extract these guidelines for individual companies, making it easier to identify match-eligible donors in your CRM.

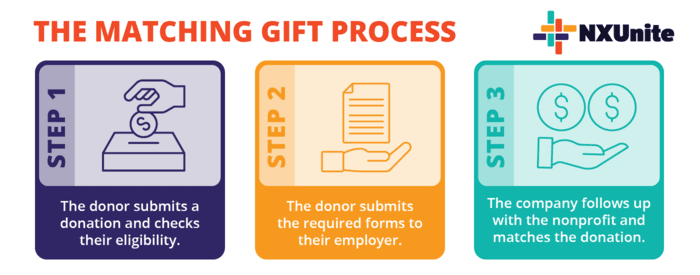

The Matching Gift Process

Luckily, the process required to receive a matching gift is pretty straightforward. When you start folding corporate giving into your priorities, make sure you train your fundraising team. That way, they can guide donors through the process if questions arise.

Here’s what will need to happen to secure a matching gift:

- The donor submits a donation and researches their eligibility. When you use a corporate matching gift tool, you can redirect each donor to a page where they enter their employer’s name to locate their program’s guidelines. From here, they can determine whether their donation is eligible for matching.

- The donor submits the required forms. Depending on whether their employer manages its program in-house or outsources it to a third-party vendor, they’ll either submit the request directly to their employer or fill out a form in an online corporate giving portal.

- The company follows up and matches the donation. The employer reviews the forms and follows up with your nonprofit to confirm the initial donation was made. If everything’s in line, the company sends your nonprofit a check!

Simplify this process even further with a tool that offers matching gift auto-submission. Backed by a platform that offers this level of innovation, donors can request corporate matches directly from their donation confirmation page, cutting out a few steps in the process.

Additional Resources

Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

12 Sample Matching Gift Letter Templates [Free Resources] – It can be a lot of work encouraging donors to check their eligibility and submit their requests. Here are some templates to help you craft your follow-up outreach.

Matching Gift Auto-Submission + CSR Platforms | What to Know – Maximize your matching gift revenue by simplifying the process for donors via auto-submission. Learn more about how auto-submission works with this guide.