Nonprofit Bookkeeping – Nonprofit Catalog

Your nonprofit works hard to raise money effectively and efficiently, so your fundraising team is often knee-deep in the process of finding new revenue streams. But what happens after those monies are acquired? How do you keep track of it all? Financial management is an essential part of your ability to fund your nonprofit’s mission, and it all starts with bookkeeping.

What Is Nonprofit Accounting?

Nonprofit bookkeeping is the process of inputting and organizing your nonprofit’s financial data. When your nonprofit makes money through fundraising, investing, or other strategies, your bookkeeper is the one to input the information about that money into your accounting system and ensure it’s labeled and allocated correctly.

When your nonprofit registered to be a 501(c)(3) organization, you received tax-exempt status. But you also agreed as a part of that registration that you would ensure a high level of transparency regarding your finances in order to maintain that status with the IRS. Therefore, it’s critical to ensure your funding is recorded properly—a task that falls directly on your bookkeeper.

At many smaller organizations, the job of bookkeeping falls largely on executive directors or high-level staff members. This creates another hat for those professionals to wear in their work at the organization. Meanwhile, large organizations with more transactions to keep track of might hire a full-time bookkeeper to manage their day-to-day finances, although hiring can be expensive. The best in-between option for nonprofits is to outsource your bookkeeping and accounting needs to an experienced, nonprofit-specific firm.

You might be asking, “Bookkeeping and accounting? Why do we need both? Aren’t they basically the same thing?” In short, no. Let’s take a closer look at the differences between these commonly confused roles.

How are Bookkeeping and Accounting Different?

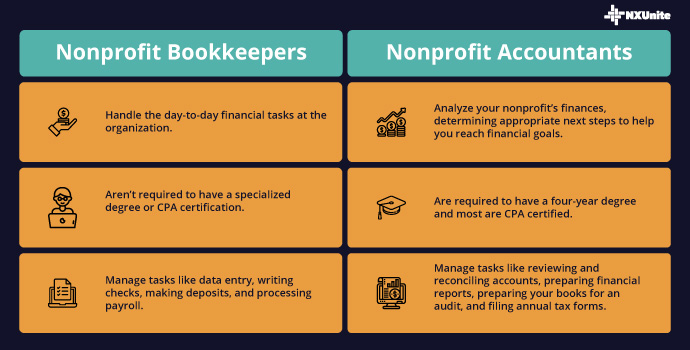

While often lumped together in one category, nonprofit bookkeeping and accounting are two distinct roles. Here are the main differences between the two:

Nonprofit Bookkeeping

Nonprofit bookkeepers manage the day-to-day operational needs of an organization. This includes tasks like data entry, writing checks, and allocating expenses. Because it tends to be fairly administrative in nature, nonprofit bookkeepers don’t usually require specialized degrees or CPA certifications. However, this doesn’t mean the job is easy! Bookkeeping requires strong organizational skills to keep everything straight.

Nonprofit Accounting

Nonprofit accounting is like the big brother to bookkeeping. Accountants analyze your nonprofit’s financial data to determine the next steps that will help your organization reach its goals. This role requires a four-year degree and most people who occupy this position are CPA-certified. Accountants also reconcile your bank accounts, prepare your books for audits, compile and submit tax forms, and create your annual budget.

Both of these roles are essential for your nonprofit to have effective financial management practices, but they’re often completed by two different people. This way, you’ll create stronger internal controls that help prevent fraud at your nonprofit.

What Does a Nonprofit Bookkeeper Do?

Your nonprofit bookkeeper’s duties are varied, but they may include tasks such as:

- Data entry. Basic data entry involves recording all of your nonprofit’s expenses, revenue, transactions, and other financial information in your dedicated accounting software or a spreadsheet.

- Writing checks and making bank deposits. When your nonprofit needs someone to go to the bank to deposit cash from in-person donations or to write the check for your water bill this month, you’ll call upon your nonprofit bookkeeper.

- Processing payroll. Larger organizations may rely on a separate HR department to process payroll, but small to mid-sized nonprofits often let this responsibility fall onto their nonprofit bookkeeper.

- Allocating expenses. Nonprofit bookkeepers are in charge of organizing the allocations for various organizational expenses. For example, they may allocate what expenses are dedicated to different programs, administrative costs, and fundraising campaigns.

As you can see, your nonprofit bookkeeper is primarily responsible for keeping all of your nonprofit’s financial information organized and ready to be acted upon. If your organization’s bookkeeping duties currently fall on your executive members of the team, consider if it’s worth it to designate a dedicated staff member or outsourced bookkeeper to help manage the responsibilities.

Additional Resources

Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog

Bookkeeping and Accounting Services for Nonprofits – Some organizations outsource their bookkeeping and accounting needs to organizations like Jitasa. Learn more about how this works and why it can benefit your nonprofit.

Year-End Giving – Your organization raises a lot of money at the end of the year. This guide will help you prepare to raise that funding and record it properly.