Starting a Foundation – Nonprofit Catalog

Starting a private foundation provides a lasting opportunity for philanthropists to donate consistently to a nonprofit and make an impact on causes they’re passionate about. If you’re considering starting a foundation or want to learn more about them, we’ll cover the basics and discuss all the important elements you’ll need to consider before diving into the process.

What is a foundation?

Instead of collecting donations from individual donors to launch their own programs and initiatives, private foundations act as the donors by giving grants to other nonprofit organizations to fund their operations. They can also provide scholarships to individuals in certain circumstances.

Foundations are private 501(c)(3) organizations, meaning they operate independently from the government but still retain a nonprofit tax-exempt status. To qualify as a private foundation, organizations must have a defined purpose, such as:

- Charitable

- Educational

- Scientific

- Religious

- Literary

Foundations are often started by a family or small group of people with a shared charitable interest, but they can also be started by a corporation. For example, Google provides grants for nonprofits for free advertising space to help them get their message out to wider audiences.

How do you decide to start a foundation?

Before making the decision to start your own foundation, do extensive research on the process and legal requirements. Evaluate both the benefits and costs of starting a foundation, and take stock of your existing resources. Consider the following information while deciding if you should start a foundation:

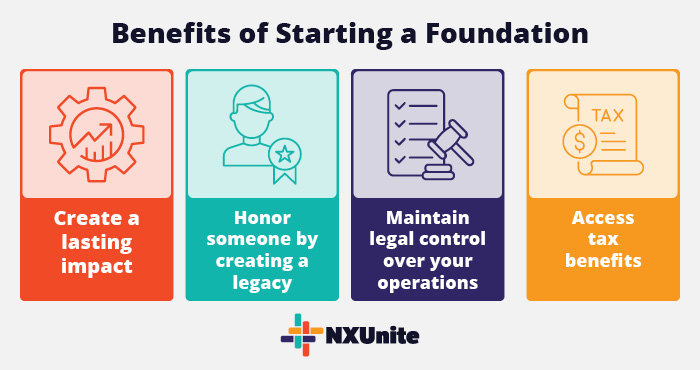

What are the benefits of starting a private foundation?

Individuals and companies start foundations for a variety of reasons, but all foundations offer the unique ability to:

- Create a significant and long-lasting personal impact on the causes you care about.

- Honor an individual or your family by creating a legacy foundation in their name.

- Maintain legal control over your operations.

- Access tax benefits, including tax-exempt status for your organization and individual tax deductions.

Consider how much you value each of these benefits and if you would be able to reap similar benefits from donating to nonprofits alone.

How much money is needed to start a foundation?

Private foundations obtain funds directly from an individual, family, or corporation, instead of from a pool of individual donors. Therefore, to start a corporation, you need to have a sizable amount of funding available in your budget to set up the foundation’s endowment. Endowments are the funds your foundation uses to make grants and cover operating costs.

How to start a foundation

Ready to dive deeper? If you’ve determined that you have the resources, passion, and commitment to start your own, follow these steps for starting a foundation:

- Define your mission and goals. Determine a clear purpose for your foundation and exactly who you want to help. Think about what you want to accomplish and what types of organizations you want to fund.

- Understand legal requirements and regulations. Research the difference between trusts and nonprofit corporations and what’s needed to establish each. Then, decide which type of foundation best fits your needs and goals. Generally, trusts have less legal requirements, but nonprofit corporations offer more flexibility. You may decide to hire a dedicated legal team to advise you on complex legal and financial matters.

- Identify potential trustees and staff. How personally involved do you want to be in your foundation’s day-to-day operations? Identify qualified staff members to help you run your foundation, along with the individuals who will serve as trustees.

- Apply to get an Employer Identification Number (EIN), then apply to become a 501(c)(3) organization. You’ll need to complete both of these formal applications to obtain your foundation’s legal 501(c)(3) status before you begin making grants.

- Set guidelines for using your endowment. Determine internal requirements for how your foundation will invest its endowment funds. For example, consider setting an annual minimum amount of funds that should stay in your endowment and a minimum amount that should be given out as grants.

Once you’ve set up your foundation legally, you can start getting familiar with the grantmaking process and considering how you want your foundation to appear to the public. Follow similar strategies for branding and marketing as other nonprofits use to ensure a positive, authentic reputation.

Additional Resources

- Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

- Grantmaking: Everything New Foundations Need to Know – Read up on grantmaking best practices to see how foundations make a difference with their donations.

- 3 Methods for Measuring Your Nonprofit’s Investment Success – Learn about how nonprofits measure success and calculate their return on investment. Foundations can use the same strategies to determine how effective their spending is.