Charitable Foundation – Nonprofit Catalog

Charitable foundations are key entities in the nonprofit world. With various types and classifications determined by the IRS, it’s important to understand the distinctions. For instance, how do private foundations differ from public charities?

Acquiring basic knowledge of how nonprofits interact with charitable foundations will allow you to develop better relationships and improve your grant application processes in the future.

What is a charitable foundation?

A foundation is a fairly loose term in the nonprofit sector that can apply to a range of 501(c)(3) organizations. They primarily focus on supporting charitable activities and programming related to areas like education, health, religion, and culture by issuing grants, or packages of funding designated for specific uses by the nonprofits that receive them.

Contributions to organizations designated by the IRS as 501(c)(3) are usually tax-deductible, since they’re made in support of charitable purposes. Although some foundations may have their own charitable programs and most conduct fundraising activities of their own, most employ their assets by awarding grants.

What are the different types of charitable organizations?

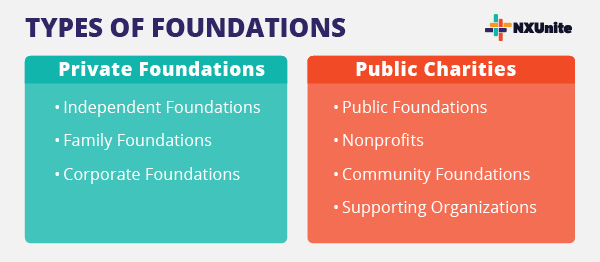

Two key categories of 501(c)(3) charitable organizations are private foundations and public charities.

Public charities are exempt from state and federal income taxes as long as they meet the requirements defined in the IRS’s Compliance Guide. However, private foundations may not be tax-exempt nor able to deduct charitable contributions unless their governing instruments contain additional special provisions.

Another difference lies in these foundations’ primary sources of financial support. While private foundations tend to be self-funded by an individual, family, or corporation, public charities often receive financial support from donations and grants.

Primary types of organizations within these two categories of charitable foundations include:

- Private Foundations

- Independent Foundations are usually self-funded by an individual or a group of individuals.

- Family Foundations are usually funded by a family’s endowment and governed by members of that family.

- Corporate Foundations, also known as company-sponsored foundations, are created and funded by a corporation. Their grants usually relate to the corporation’s activities. The Google Ad Grants program, for instance, is part of Google’s corporate philanthropy arm.

- Public Charities

- Public Foundations make up one of the largest groups of public charities. These foundations are a significant source of grants, primarily allocating their budget towards providing financial support to communities and other organizations.

- Nonprofits, rather than issue grants, prioritize performing charitable activities to further their social causes. For these organizations, it’s crucial to conduct and share impact measurements to assure donors of the results that their funds help to achieve. This type of public charity can include schools, churches, and nonprofit hospitals.

- Community Foundations largely focus on providing funds to support charitable projects in a specific community or geographical area. By examining local areas of need, they help finance initiatives such as human services, healthcare, or educational programs.

- Supporting Organizations, such as the philanthropic branch of a hospital or university, support and associate themselves with another specific organization.

Generally, most foundations that fall within these categories offer grants to other nonprofits. Understanding their individual distinctions will help you navigate your interactions with them and determine the best ways to make a case for support and communicate your impact.

What do charitable foundations do?

Like other nonprofits, foundations have their own missions. Most drive impact by providing financial support to other organizations whose goals align with their own. Nonprofits with powerful impact stories are especially likely to gain support from these grantmakers, along with other potential contributors.

Depending on the type of foundation and its goals, it might also conduct research or educational services. Charitable branches of healthcare institutions and universities can be essential sources of funding for nonprofit organizations.

Additionally, public foundations tend to conduct their own fundraising initiatives and activities. Just like other nonprofits, it’s important for all foundations to remain compliant with the appropriate standards of conduct, though the outlined requirements may differ slightly depending on their classifications.

How do nonprofits interact with charitable foundations?

501(c)(3) charitable nonprofits usually interact with foundations through the grant seeking process. Whether you’re composing an annual appeal to donors or applying for a grant, be sure to emphasize your nonprofit’s story and impact when asking for support.

In order to fulfill their own missions to drive impact, foundations devote much consideration towards responsibly stewarding their assets and allocating them in ways that will result in the most measurable impact. Because of this, the grant seeking process for nonprofits can be competitive and challenging.

To ensure success, prioritize understanding a foundation’s priorities, mission, and guidelines as you attempt to capture their attention with a proposal. Nonprofits with well-aligned missions and proposals tailored to the foundation’s requirements and priorities will have the best shot at getting approved for a grant.

Another significant interaction between nonprofits and charitable organizations lies in the grant management and reporting process. For foundations and donors alike, it’s important to know where their contributions are adding up and what kind of impact they’re having. SureImpact’s guide to nonprofit impact measurement provides concrete steps for sharing impact results and strengthening relationships with financial supporters.

Cultivating trusting relationships with foundations can lead to more successful grant proposals in the future, so take the time to communicate thoughtfully according to the funder’s guidelines!

Additional Resources

Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

Nonprofit Bookkeeping – Nonprofit Catalog – As a 501(c)(3) organization, your nonprofit must abide by some guidelines and regulations set forth by the IRS. Learn more about the essentials in this introduction to bookkeeping.

Corporate Philanthropy – Nonprofit Catalog – In addition to grants, corporations can offer matching donations and in-kind donations. Take a look at the various types of corporate philanthropy and their benefits.