Nonprofit Endowment – Nonprofit Catalog

For many nonprofit professionals, endowments can seem like a tricky subject, causing them to veer away from creating this type of fund.

And though they’re often managed by universities and other large organizations with sizable donor pools, nonprofit endowments aren’t just for wealthy organizations. In fact, professionals at small and mid-sized nonprofits can also boost the sustainability of their work when they take the time to learn about smart fundraising strategies like managing an endowment.

We’ll explore the basics of developing and managing a nonprofit endowment fund for any-sized nonprofit.

What Is a Nonprofit Endowment?

A nonprofit endowment is a pool of donations set aside and invested, allowing it to grow and financially support the work of a philanthropic organization. After the seed money (i.e. the principal) is invested, part of the earnings is paid out as an annual distribution.

Educational institutions, religious organizations, and social-service organizations all use this type of investment fundraising to grow their assets. These funds can be used for a range of purposes, such as:

- Supporting your general operational budget

- Providing scholarships

- Marketing events and projects

- Funding major projects and initiatives

Unlike your reserve fund, endowments are planned to be grown rather than spent in full. With an endowment, your initial investment amount will stay intact and growing.

Types of Nonprofit Endowments

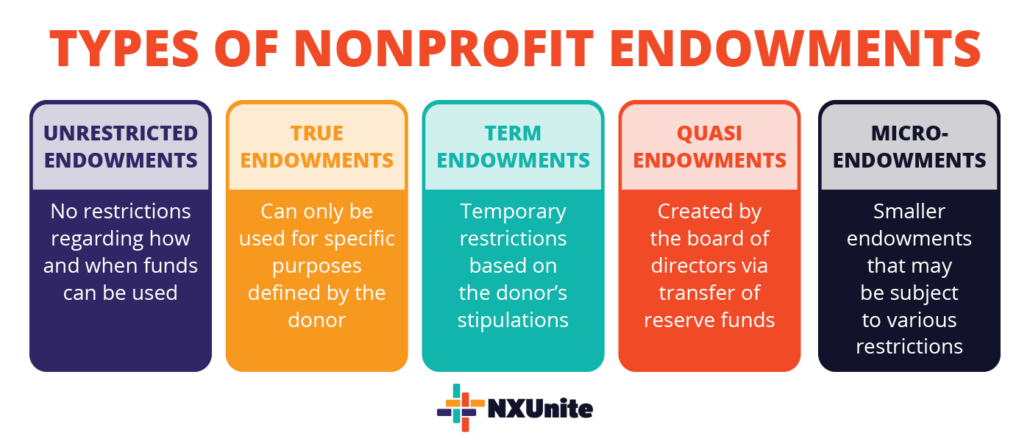

We can categorize nonprofit endowments into different types depending on how they can be used. Infinite Giving’s guide to nonprofit endowments breaks them down into these five categories:

- Unrestricted endowments aren’t subject to any restrictions regarding how and when they can be used. As the most common type of endowment, unrestricted endowments allow you to use funds whenever and wherever it’s needed most.

- Permanently restricted (or true) endowments are subject to restrictions that never end. The principal and its earnings can only be used for the specific purpose the donor defines.

- Temporarily restricted (or term) endowments are similar to true endowments, except that restrictions only exist for a limited period of time. During that time, funds from these endowments are subject to conditions the donor places, such as what it can be spent on. After the term expires, the principal and interest money may be used without restrictions.

- Quasi endowments are created by the organization’s board of directors via a transfer of reserve funds. The board sets stipulations regarding when the principal amount and any earnings can be withdrawn.

- Micro-endowments are small endowments that make endowment giving more accessible to donors. When managed effectively, micro-endowments can grow substantially and fund salaries and programs just like any other endowment.

When looking at these options, consider which types will best support your nonprofit’s needs. For instance, smaller organizations may lean into micro-endowments, attracting a range of donors.

What to Consider Before Starting a Nonprofit Endowment

Smart investment strategies can strengthen your nonprofit’s sustainability. However, there are a few aspects you’ll want to consider before committing to this approach to investing.

Benefits of Endowments for Nonprofits

Organizations of all sizes turn to this type of fundraising and for good reason. Creating an endowment for your nonprofit provides you with a stable source of income, taking the pressure off your team to meet your minimum budgetary needs. You’ll be able to grow your assets alongside your general annual fundraising practices.

Benefits of Endowments for Donors

Just as organizations are drawn to this type of fundraising, nonprofit endowments attract major donors as well. For one, it gives donors a way to stay connected with your cause over time.

What’s more, micro-endowments are a great way to attract low and mid-level donors who want to deepen their engagement with your cause. As with any donation, donors can also typically claim their endowment gift on their tax deductions.

When it comes to true and term endowments, donors have more control over their gifts. They can be confident that their funds are going to the programs they’re most passionate about.

Challenges

As with any fundraising strategy, there are some challenges you’ll want to think through before diving headfirst into endowment fundraising, including:

- Managing a nonprofit endowment might not be financially viable if you have an immediate need for funds.

- There’s an inherent risk when it comes to investing, so you might choose to keep part of your endowment as cash reserves.

- You might need to outsource management to a professional investment manager or invest in in-depth fundraising training.

Luckily, modern tools that streamline investment processes have revolutionized the nonprofit world, making it easy to overcome these challenges without breaking the bank. Backed by the right tools, you can accept and manage your endowment donations with confidence.

How to Start an Endowment for Nonprofits

You’ve weighed the pros and cons of starting a nonprofit endowment and decided it’s a smart move for your team. Great!

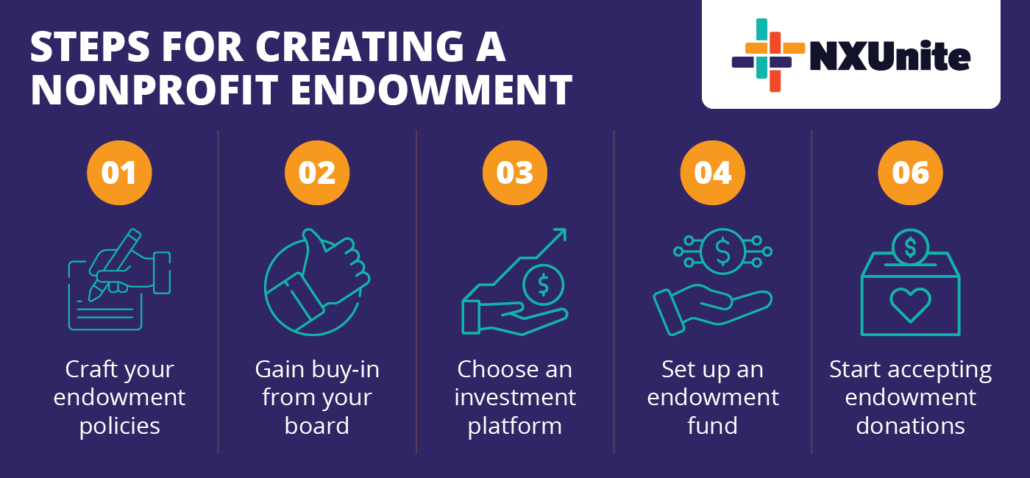

Now, it’s time to take the next step and actually create your endowment. To make sure that it meets your organization’s needs and goals, follow these steps:

- Craft your endowment policies. Define the endowment’s purpose, what it’ll be used for, what type of endowment it is, how it’ll be funded, and how funds will be invested and managed.

- Gain buy-in from your board. Your board is responsible for setting your organization’s strategic direction and ensuring proper fund management. Present your policies and explain how a nonprofit endowment can fit into your financial strategies.

- Choose an investment platform. An investment platform can simplify endowments significantly, enabling you to accept and invest endowment donations. Choose a provider with secure management tools, an easy-to-use interface, and trustworthy services from a Registered Investment Advisor (RIA).

- Set up an endowment fund. Create an account with your provider. You’ll likely need to share your application, Articles of Incorporation, and 501(c)(3) IRS Determination Letter. Once they activate your account, you can select a portfolio and your annual disbursement.

From here, you’re ready to market the opportunity to donors and start accepting donations. Your giving platform will handle the heavy lifting, so you can focus on engaging donors and soliciting gifts.

Additional Resources

Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

How to Accept Stock Donations: The Ultimate Nonprofit Guide – Investment fundraising is an incredible opportunity for nonprofits. Start accepting stock donations by following the guidance in this article!

Managing Nonprofit Reserve Funds: The Ultimate Guide – Explore this guide to make sure you’re prepared to weather financial setbacks by properly managing your reserve funds.