Is your organization fully utilizing the most reliable form of recurring revenue available? For many nonprofits and universities, the search for sustainable funding is a daily priority. Payroll giving offers a distinct solution by allowing your supporters to automate donations directly from their corporate paychecks, providing your nonprofit with a steady stream of unrestricted funds.

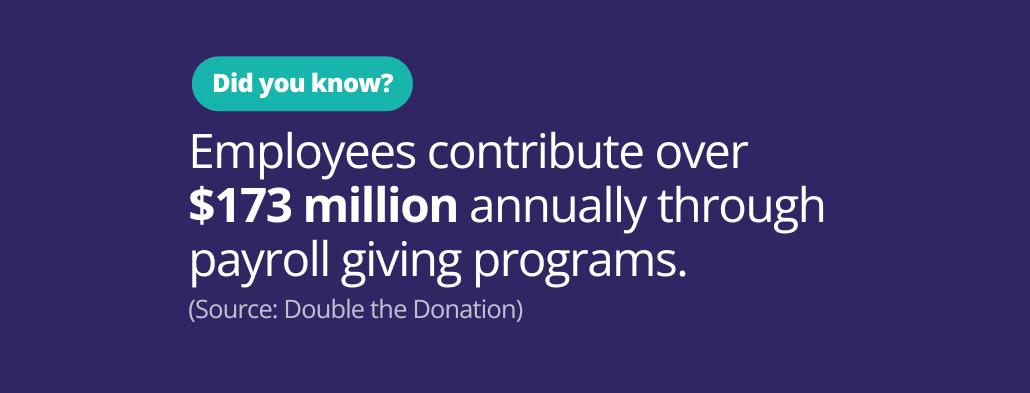

The potential here is massive, yet largely untapped. According to statistics gathered by Double the Donation, employees contribute over $173 million annually through payroll giving programs worldwide. However, a significant barrier remains: 59% of people have never heard of payroll giving. This lack of awareness presents both a challenge and an opportunity. While the revenue potential is high, supporters cannot sign up for programs they do not know exist.

In this guide, we will address the most common questions regarding workplace giving and how it functions alongside other corporate giving programs, like matching gifts. We will also examine how fundraising software can help you identify eligible donors, streamline the giving process, and ultimately increase the revenue necessary to support your mission.

1. What is payroll giving, and how does it benefit nonprofits?

Payroll giving allows employees to donate directly from their paycheck using automatic deductions set through their employer. Often, these programs are open choice programs, meaning that employees have the option to support any nonprofit or school of their choice through their payroll giving program. As a result, these programs provide sustainable funding opportunities for a large number of nonprofits.

While many companies promote payroll giving through their employee portal (commonly a workplace giving platform), many employees are unaware of the option, meaning that nonprofits miss out on potential revenue opportunities. To increase participation and benefit from these funds, nonprofits should educate supporters about payroll giving and encourage supporters to check their eligibility.

2. Why is payroll giving important for my nonprofit?

Payroll gifts often produce consistent revenue at scale because many donors prefer simple, recurring deductions, and if their employer offers one of these programs, this is an easy way for them to get involved. If you have a medium to large nonprofit, you will likely see strong results because of your larger supporter base. You can also benefit from higher brand awareness which encourages employees to enroll.

Payroll giving programs typically attract long-term donors who value easy automated contributions. Your nonprofit can support these donors by providing workplace giving information on your website and using fundraising tools to help donors confirm eligibility quickly.

3. What types of companies typically offer payroll giving programs?

Payroll giving has evolved into a benefit offered by businesses of all sizes, industries, and regions. Today, companies ranging from local mid-sized firms to global leaders in technology, finance, healthcare, and retail (such as Microsoft and The Home Depot) provide these programs to boost employee engagement. Some employers combine payroll giving with matching gift programs which doubles donor impact.

Because the opportunities are so widespread, the barrier to entry is not finding a company that offers it, but ensuring you are visible within their system.

Most of these companies use corporate social responsibility (CSR) platforms to process the deductions and distribute the funds. Therefore, a critical operational step for your team is to ensure your nonprofit is registered and capable of receiving electronic transfers (EFT) on these major platforms. If you are not in the system, a willing donor often cannot select you as a beneficiary.

Once you are registered, you can use a corporate giving database like Double the Donation to help your supporters identify their eligibility and guide them to the correct portal to set up their deduction.

4. How much revenue can payroll giving generate for my nonprofit?

Revenue varies widely depending on organization size and the number of your supporters that are eligible. However, many nonprofits see consistent monthly contributions that accumulate significantly across large donor bases.

Payroll gifts often remain active for years because deductions feel manageable for donors. This creates long-term revenue streams that support ongoing programs.

Your nonprofit can increase revenue by simplifying supporter discovery through payroll giving tools. Most nonprofits see meaningful results when payroll giving is promoted consistently.

5. How does payroll giving differ from traditional recurring donations?

To put simply, payroll giving happens through employer systems while recurring donations are set up directly through the nonprofit.

However, the most significant difference for the donor is the tax advantage. For payroll giving, donations are often deducted from an employee’s salary before tax is applied (pre-tax). This provides immediate tax relief for the donor, meaning it costs them less to give more. Because the funds are deducted before they ever hit the employee’s bank account, it simplifies financial planning and budgeting. Meanwhile, recurring gifts are typically paid from post-tax income, requiring the donor to claim tax deductions manually at the end of the year.

For the organization, the difference lies in retention. Traditional recurring gifts often churn due to expired credit cards or changed bank details. Payroll gifts, however, remain active as long as the employee stays with the company, providing a much more stable and long-term revenue stream. Additionally, because these gifts are routed through corporate systems, they are frequently bundled with matching gift opportunities, doubling the value of the donation automatically.

6. Are payroll giving donations tax deductible for employees?

Most payroll gifts are tax deductible because they are treated as charitable donations. Employees receive documentation through employer payroll systems, and this simplifies tax preparation for many donors.

While you do not need to issue separate receipts for payroll gifts, your nonprofit should still acknowledge gifts to support donor stewardship and engagement.

7. What challenges do nonprofits face when managing payroll giving?

The primary challenge is data inconsistency. Unlike recurring giving where you instantly receive the donor’s name, email, and amount, payroll giving funds are often disbursed through third-party corporate social responsibility (CSR) platforms that handle data very differently.

Nonprofits often face the “lump sum” reality, where they receive a single aggregate check for a certain amount that represents contributions from different employees, with little to no individual identifying information. This happens for two reasons: platform variance and privacy settings.

Every CSR platform has different reporting standards. Some provide detailed breakdowns, while others provide minimal aggregate data. Additionally, employees often have the option to give anonymously through their workplace portal, meaning the funds arrive without a name attached.

This lack of visibility makes donor stewardship incredibly difficult. If you cannot identify the individual behind the donation, you cannot thank them, which risks future retention.

To solve this, your nonprofit can use fundraising software to capture employment data. By using tools to identify where your supporters work (via search tools on your website or employer appends), you create a separate data stream. This allows you to identify potential payroll donors and steward them proactively.

8. How can my nonprofit know if a supporter is eligible for payroll giving?

Eligibility depends on employer benefit policies which vary widely across industries. Donors often do not know whether payroll giving exists at their company.

Your nonprofit can guide supporters by directing them to a payroll giving search tool. With a dedicated payroll giving plugin, you can help supporters confirm available programs quickly and give them a direct link to their next steps for payroll giving enrollment, while reducing staff workload and increasing overall participation.

9. How does my nonprofit get payroll giving funds?

Funds are usually distributed through workplace giving platforms on a scheduled basis, and payments may be bundled with other workplace donations.

With payroll giving, nonprofits receive aggregate transfers rather than individual donor payments. These transfers include basic remittance details which vary by platform. We recommend monitoring recurring reports to improve tracking and support accurate donor stewardship.

10. What misconceptions do nonprofits have about payroll giving?

Misconceptions often prevent nonprofits from pursuing payroll giving, causing them to leave significant revenue on the table. Here are the two most common myths and the data that debunks them:

- Myth #1: Payroll giving programs are uncommon and don’t generate much revenue. The Reality: Payroll giving is a significant source of funds across the globe. According to statistics gathered by Double the Donation, employees contribute over $173 million annually through payroll giving programs. This demonstrates the worldwide potential of payroll giving programs as a reliable revenue stream for nonprofits like yours. Far from being “niche,” thousands of employers, from the Fortune 500 to local businesses, also offer these programs as a standard benefit.

- Myth #2: Payroll giving requires a complex setup. The Reality: The technical setup is generally straightforward because the heavy lifting is done by the corporate CSR platforms. The real challenge is simply getting donors to notice it. This proves that the challenge and the opportunity is the lack of marketing and visibility of payroll giving programs.

It is also common for nonprofits to overlook payroll giving as a pipeline for matching gifts. By using a fundraising tool like Double the Donation, you can help supporters discover both opportunities easily. A clear promotion and marketing plan will help your nonprofit overcome these misconceptions.

Payroll Giving At A Glance

Implementing a strategy to capture payroll giving can help you secure immediate funds and build a foundation of financial stability for your organization. By understanding the mechanics of payroll match programs and utilizing the right fundraising software, you can transform sporadic donors into long-term partners in your mission.

We encourage you to audit your current donation forms to see if you are adequately capturing employment data. Small adjustments to your donor journey can reveal significant opportunities for workplace giving growth.

To learn more about payroll giving and other forms of workplace giving, explore more resources from Double the Donation and implement best practices, streamline processes, and capture more payroll gifts today.

6 Tips to Create an Ambassador Program for Your Nonprofit

According to Bloomerang’s Mission Retainable Report, 30% of the fundraisers surveyed identified donor fatigue as a challenge they face, and 87% of donors who stop or reduce their support do so due to financial strain. What if there were a way to continuously engage donors and have them contribute meaningfully to your cause without requiring them to make additional monetary donations?

Look no further than an ambassador program. Ambassadors can take the reins during fundraising or marketing campaigns, promoting your organization to their personal networks and expanding your reach.

This form of peer-to-peer marketing is highly compelling because people are more likely to support a cause that’s recommended by someone they know and trust. Additionally, donors and other supporters can unlock another opportunity to help your cause without reaching back into their wallets.

To ensure your ambassador program gets up and running quickly and yields a high return on investment, we’ll explore top tips for developing an effective program.

1. Identify the right recruits.

Supporters often want more than just to help promote your nonprofit’s cause—they want to feel like members of your community. An ambassador program gives them an outlet to express their passion for your mission and share their enthusiasm with others.

Search for individuals who have a strong existing relationship with your organization and are particularly vocal about their love for your cause. Potential ambassadors could be:

Use your nonprofit CRM to identify long-time, highly engaged supporters. Filter your database by length of involvement or number of interactions to find your top supporters. You may also look for supporters with strong community connections—such as local business owners or microinfluencers—who have built-in audiences with whom they could share your cause.

Then, personally reach out to these individuals with an invitation to join your ambassador program. Reference their past involvement to explain why you’re reaching out. For example, you might say something like:

Eliza, we are so excited to invite you to join our new ambassador program. Your passionate volunteer involvement and past peer-to-peer fundraising experience make you a perfect fit for our new program.

2. Brand your ambassador program.

People will be more likely to sign up for your ambassador program if it looks professional and matches your organization’s current branding. They’ll be confident the program belongs to your nonprofit and feel encouraged to sign up.

While you may use the same colors, visual style, and messaging as your overarching nonprofit brand, develop the following unique brand elements for your program:

Then, incorporate these brand elements into your promotional materials, such as your social media posts and personal emails to potential participants, ensuring everything matches.

For example, here’s a flyer for a fictional environmental nonprofit ambassador program with a cohesive brand:

This flyer features the organization’s brand name, logo, and a QR code that potential participants can scan for more information.

You can also boost the sense of community by creating branded merchandise for your program, such as hats, T-shirts, or name tags. Offering new ambassadors matching items will help them feel like members of an exclusive team.

3. Create clear roles and expectations.

Ultimately, your ambassador program shouldn’t just provide new engagement opportunities for supporters. It should also tangibly support your marketing and fundraising efforts.

Take the following steps to ensure your ambassador program bolsters your existing strategies:

When potential ambassadors understand what your program entails, you can narrow down your recruit list to just individuals who feel comfortable with the role expectations. And with clear metrics to guide your program, you can determine whether it’s a worthwhile use of your time and resources.

4. Provide proper training and resources.

Invite your ambassadors to a training session to help them get up and running in their new roles. Depending on where your ambassadors are located, you might host a virtual or in-person meeting. Reiterate the role expectations and let ambassadors get to know one another through some icebreaker activities.

Additionally, craft a training manual for ambassadors to follow while promoting your organization. Your manual should include your brand guidelines, ambassador program regulations, and marketing materials that ambassadors can use in their promotional efforts, such as:

Let ambassadors know that they can come to you at any time with questions or concerns. You may even set up a mentorship or buddy program within your ambassador group to ensure each participant has at least one peer they can turn to for support.

5. Build community among ambassadors.

Fostering a strong community among your ambassadors can encourage program retention. Plus, when ambassadors have fun supporting your mission and feel engaged in your cause, their promotional efforts will be much more genuine.

Spark connections within your ambassador program by:

In addition to letting ambassadors recognize each other, implement appreciation strategies like publicly shouting out ambassadors on social media and within blog posts, sending thank-you gifts, and sharing personalized messages to demonstrate your gratitude for their contributions.

6. Evaluate and adapt your program as needed.

As your ambassador program gets underway, you might find that certain strategies aren’t working out as expected. Remain flexible and adjust your program when necessary to continue offering a high-quality experience to participants and ensure that your program effectively supports your nonprofit.

Continuously evaluate your program by taking the following steps:

Supporting your ambassadors every step of the way is one of the most effective ways to ensure a high ROI for your program. Take ambassadors’ feedback seriously to ensure you’re continuing to meet their needs and providing a positive experience.

An ambassador program presents a win-win situation. While your ambassadors can help you connect with new potential donors, spread awareness of your mission more effectively, and help sustain your current fundraising and marketing efforts, they also receive a fulfilling experience that allows them to meet new people and drive greater impact. Promote your ambassador program across channels, and as your program grows, collect ambassador testimonials you can use as social proof to recruit even more program participants.

Payroll Giving Essentials FAQ: How Nonprofits Can Unlock Recurring Revenue

Is your organization fully utilizing the most reliable form of recurring revenue available? For many nonprofits and universities, the search for sustainable funding is a daily priority. Payroll giving offers a distinct solution by allowing your supporters to automate donations directly from their corporate paychecks, providing your nonprofit with a steady stream of unrestricted funds.

The potential here is massive, yet largely untapped. According to statistics gathered by Double the Donation, employees contribute over $173 million annually through payroll giving programs worldwide. However, a significant barrier remains: 59% of people have never heard of payroll giving. This lack of awareness presents both a challenge and an opportunity. While the revenue potential is high, supporters cannot sign up for programs they do not know exist.

In this guide, we will address the most common questions regarding workplace giving and how it functions alongside other corporate giving programs, like matching gifts. We will also examine how fundraising software can help you identify eligible donors, streamline the giving process, and ultimately increase the revenue necessary to support your mission.

1. What is payroll giving, and how does it benefit nonprofits?

Payroll giving allows employees to donate directly from their paycheck using automatic deductions set through their employer. Often, these programs are open choice programs, meaning that employees have the option to support any nonprofit or school of their choice through their payroll giving program. As a result, these programs provide sustainable funding opportunities for a large number of nonprofits.

While many companies promote payroll giving through their employee portal (commonly a workplace giving platform), many employees are unaware of the option, meaning that nonprofits miss out on potential revenue opportunities. To increase participation and benefit from these funds, nonprofits should educate supporters about payroll giving and encourage supporters to check their eligibility.

2. Why is payroll giving important for my nonprofit?

Payroll gifts often produce consistent revenue at scale because many donors prefer simple, recurring deductions, and if their employer offers one of these programs, this is an easy way for them to get involved. If you have a medium to large nonprofit, you will likely see strong results because of your larger supporter base. You can also benefit from higher brand awareness which encourages employees to enroll.

Payroll giving programs typically attract long-term donors who value easy automated contributions. Your nonprofit can support these donors by providing workplace giving information on your website and using fundraising tools to help donors confirm eligibility quickly.

3. What types of companies typically offer payroll giving programs?

Payroll giving has evolved into a benefit offered by businesses of all sizes, industries, and regions. Today, companies ranging from local mid-sized firms to global leaders in technology, finance, healthcare, and retail (such as Microsoft and The Home Depot) provide these programs to boost employee engagement. Some employers combine payroll giving with matching gift programs which doubles donor impact.

Because the opportunities are so widespread, the barrier to entry is not finding a company that offers it, but ensuring you are visible within their system.

Most of these companies use corporate social responsibility (CSR) platforms to process the deductions and distribute the funds. Therefore, a critical operational step for your team is to ensure your nonprofit is registered and capable of receiving electronic transfers (EFT) on these major platforms. If you are not in the system, a willing donor often cannot select you as a beneficiary.

Once you are registered, you can use a corporate giving database like Double the Donation to help your supporters identify their eligibility and guide them to the correct portal to set up their deduction.

4. How much revenue can payroll giving generate for my nonprofit?

Revenue varies widely depending on organization size and the number of your supporters that are eligible. However, many nonprofits see consistent monthly contributions that accumulate significantly across large donor bases.

Payroll gifts often remain active for years because deductions feel manageable for donors. This creates long-term revenue streams that support ongoing programs.

Your nonprofit can increase revenue by simplifying supporter discovery through payroll giving tools. Most nonprofits see meaningful results when payroll giving is promoted consistently.

5. How does payroll giving differ from traditional recurring donations?

To put simply, payroll giving happens through employer systems while recurring donations are set up directly through the nonprofit.

However, the most significant difference for the donor is the tax advantage. For payroll giving, donations are often deducted from an employee’s salary before tax is applied (pre-tax). This provides immediate tax relief for the donor, meaning it costs them less to give more. Because the funds are deducted before they ever hit the employee’s bank account, it simplifies financial planning and budgeting. Meanwhile, recurring gifts are typically paid from post-tax income, requiring the donor to claim tax deductions manually at the end of the year.

For the organization, the difference lies in retention. Traditional recurring gifts often churn due to expired credit cards or changed bank details. Payroll gifts, however, remain active as long as the employee stays with the company, providing a much more stable and long-term revenue stream. Additionally, because these gifts are routed through corporate systems, they are frequently bundled with matching gift opportunities, doubling the value of the donation automatically.

6. Are payroll giving donations tax deductible for employees?

Most payroll gifts are tax deductible because they are treated as charitable donations. Employees receive documentation through employer payroll systems, and this simplifies tax preparation for many donors.

While you do not need to issue separate receipts for payroll gifts, your nonprofit should still acknowledge gifts to support donor stewardship and engagement.

7. What challenges do nonprofits face when managing payroll giving?

The primary challenge is data inconsistency. Unlike recurring giving where you instantly receive the donor’s name, email, and amount, payroll giving funds are often disbursed through third-party corporate social responsibility (CSR) platforms that handle data very differently.

Nonprofits often face the “lump sum” reality, where they receive a single aggregate check for a certain amount that represents contributions from different employees, with little to no individual identifying information. This happens for two reasons: platform variance and privacy settings.

Every CSR platform has different reporting standards. Some provide detailed breakdowns, while others provide minimal aggregate data. Additionally, employees often have the option to give anonymously through their workplace portal, meaning the funds arrive without a name attached.

This lack of visibility makes donor stewardship incredibly difficult. If you cannot identify the individual behind the donation, you cannot thank them, which risks future retention.

To solve this, your nonprofit can use fundraising software to capture employment data. By using tools to identify where your supporters work (via search tools on your website or employer appends), you create a separate data stream. This allows you to identify potential payroll donors and steward them proactively.

8. How can my nonprofit know if a supporter is eligible for payroll giving?

Eligibility depends on employer benefit policies which vary widely across industries. Donors often do not know whether payroll giving exists at their company.

Your nonprofit can guide supporters by directing them to a payroll giving search tool. With a dedicated payroll giving plugin, you can help supporters confirm available programs quickly and give them a direct link to their next steps for payroll giving enrollment, while reducing staff workload and increasing overall participation.

9. How does my nonprofit get payroll giving funds?

Funds are usually distributed through workplace giving platforms on a scheduled basis, and payments may be bundled with other workplace donations.

With payroll giving, nonprofits receive aggregate transfers rather than individual donor payments. These transfers include basic remittance details which vary by platform. We recommend monitoring recurring reports to improve tracking and support accurate donor stewardship.

10. What misconceptions do nonprofits have about payroll giving?

Misconceptions often prevent nonprofits from pursuing payroll giving, causing them to leave significant revenue on the table. Here are the two most common myths and the data that debunks them:

It is also common for nonprofits to overlook payroll giving as a pipeline for matching gifts. By using a fundraising tool like Double the Donation, you can help supporters discover both opportunities easily. A clear promotion and marketing plan will help your nonprofit overcome these misconceptions.

Payroll Giving At A Glance

Implementing a strategy to capture payroll giving can help you secure immediate funds and build a foundation of financial stability for your organization. By understanding the mechanics of payroll match programs and utilizing the right fundraising software, you can transform sporadic donors into long-term partners in your mission.

We encourage you to audit your current donation forms to see if you are adequately capturing employment data. Small adjustments to your donor journey can reveal significant opportunities for workplace giving growth.

To learn more about payroll giving and other forms of workplace giving, explore more resources from Double the Donation and implement best practices, streamline processes, and capture more payroll gifts today.

5 Tips for Turning New Donors into Lifelong Supporters

The golden rule of fundraising is that supporters who give a second time are far more likely to give long-term. Subsequently, many nonprofit fundraising strategies focus on encouraging new supporters to commit to future gifts.

While a certain percentage of new donors are only interested in making one-time gifts, nonprofits that employ the right strategies can turn many of them into recurring supporters. To help your nonprofit create lasting supporter relationships, this guide will explore five strategies for connecting with new donors.

1. Deliver prompt, personal acknowledgements.

After a supporter donates, send them a thank-you message within 48 hours. Many nonprofits leverage automated thank-you messages to ensure donors are recognized promptly, but generic emails only go so far in making donors feel appreciated.

Start your relationship with new donors off on the right foot by sending them gift acknowledgment messages that:

All donors should receive a thank-you message, but you may go the extra mile for major giving prospects. For these supporters, you might send a handwritten note, a gift like a bouquet of flowers, or even give them a call to start building a personal connection.

2. Create a welcome series.

New donors have made an investment in your organization, and want to continue supporting you in other ways. Create a welcome series to steward these donors and guide them on how to get further involved in your nonprofit’s cause.

A welcome series usually refers to a series of emails delivered over the course of a few weeks. However, some nonprofits experiment with other types of welcome materials, such as short videos or digital tours. Others will even mail welcome packages to promising major giving prospects that include gifts like branded merchandise.

3. Maintain consistent communication.

The donation lifecycle relies on maintaining regular contact with supporters. After new supporters make their first gift, your messages should help move them through the donor journey until they are ready to contribute again.

Build relationships with your new donors by communicating with them consistently. Start by:

Your other marketing efforts aimed at acquiring new donors will also help you maintain your current supporters. New and existing donors will see your social media posts, paid ads, and other external content, building brand awareness and reminding them to check in on your nonprofit.

4. Demonstrate donors’ impact.

If donors feel like their contributions are not making a difference, they may stop giving. Prevent this by ensuring donors understand how their gifts are being used and the impact they have on your cause.

Facts and statistics provide the hard numbers donors need to quantifiably know their gifts matter. However, stories, testimonials, and anecdotes are often more useful at helping donors visualize their impact. These emotional appeals can also encourage donors to take a personal investment in your cause, increasing the chances they will support you long-term.

Interview your staff, volunteers, beneficiaries, and other program participants to gather stories you can share with your donors. When possible, take pictures and videos to add a visual element. Pairing images of your nonprofit in action with emotional stories lets donors see exactly what kind of work your organization does and envision how their specific gifts might contribute.

5. Offer multiple engagement opportunities.

Lifelong supporters need engagement opportunities outside of donating. While these supporters will still donate, if monetary transactions are their only interactions with your nonprofit, they will likely feel less invested in your organization.

Here are a few engagement opportunities you might offer:

Ensure that getting involved with your nonprofit outside of donating is easy. Your website should provide information about various opportunities and instructions on how to participate, and your communications should regularly promote these programs.

Lifelong supporters are essential for providing sustainable revenue, and the key to turning first-time donors into these valued supporters is consistent communication, personal connection, and an engaging donor experience. Start improving your new donor retention and lifetime value by creating a prompt, consistent supporter communication strategy.

Post-Event Engagement Plans: How to Keep the Momentum Going

Did you know that hybrid events can increase revenue by up to 15% for organizers? Or that 81% of U.S. donors attend nonprofit fundraising events each year?

That’s a massive opportunity for nonprofits to boost revenue and engagement, but only if you know what to do after the attendees go home and the tables are cleared.

Considering all the planning that goes into your fundraiser, from choosing a venue to securing sponsorships, it’s easy to look at the end of the event as a finish line. However, it’s actually a starting line for long-term relationships, and your post-event strategy is what truly converts a one-time attendee into a long-term donor.

There’s a three-stage framework you can follow to keep your momentum strong: Connect, Share, and Invite. Let’s break it down.

Connect With Attendees Through Personalized Gratitude

The clock starts the moment your event ends. The most effective follow-up happens within 24 to 48 hours, and it starts with a heartfelt “thank you.”

Send a short, personalized email or letter that addresses recipients by name and acknowledges their specific role, whether they attended, volunteered, donated, or sponsored. Sincere appreciation sets the tone for ongoing engagement.

According to CharityEngine, event software can streamline this follow-up through features, such as:

Add a short highlight reel or photo gallery to your message to enhance its visual appeal. Let your attendees relive the magic and reinforce the positive emotions tied to your mission.

Share Your Mission and Impact Story

After your thank-yous are sent, shift the focus from the event to your impact. You’re now moving from gratitude to storytelling and stewardship.

Your post-event communications should include:

Finally, send a short, focused post-event survey (no more than 10 questions). Ask what resonated most, what could be improved, and whether they’d like to be more involved. This shows you value their opinion, and it gives you data to make your next event even stronger.

Invite Donors to Deeper Involvement

Now that your audience feels connected and informed, it’s time to invite them further into your mission. Resist the urge to jump straight to another donation request! Many have likely already contributed through tickets or gifts.

Instead, offer low-friction engagement opportunities that build loyalty:

Each follow-up should include a clear call to action (CTA)—join a volunteer team, subscribe to your monthly giving program, or register for the next event. Keep it simple, specific, and easy to act on.

The event itself may end in one night, but the momentum you build afterward determines your long-term success. Post-event engagement is the real engine of ROI; it’s the disciplined, personalized, and strategic follow-up that transforms fleeting excitement into lasting loyalty.

So, the next time you’re wrapping up a big fundraiser, remember: this isn’t the end. It’s the beginning of a deeper connection between your supporters and your mission.

3 Data Utilization Tips for Healthcare Association Members

Data is an invaluable asset for decision-making in any sector. Considering that the healthcare industry produces approximately 30% of the world’s data, health professionals are well-equipped to make informed, reliable decisions.

Here’s the kicker: The value you derive from your data depends on the way you collect, manage, and analyze it. If you’re a healthcare association leader, it isn’t enough to simply advise members to use their data—you need to explain how they should use it.

In this guide, we’ll cover a few practical ways your healthcare association can train its members to use data wisely and glean meaningful insights from it. More than teaching members how to put their data to work, these tips will help you steward relationships with members who value relevant, actionable insights.

Aggregate and Organize Data

Imagine you’re writing a review of a movie, but you only watched one scene. Or, let’s say you stopped reading a book after finishing the first chapter. Would you feel prepared to summarize the plot to a friend?

Just as you can’t fully analyze a movie or a book without having all of the necessary information, health data won’t provide useful insights without comprehensive and accurate data points.

According to Arcadia, healthcare data aggregation is the process of consolidating different data into one place. By enabling health professionals to review data in its full context, this practice helps to identify widespread patterns and trends, plan next actions accordingly, and even forecast future events to allow for early interventions.

Here are a few ways to educate association members on aggregating health data effectively:

Lean on your learning management system (LMS) to integrate these tips into your broader teaching materials. Since data aggregation is a fairly high-level topic to cover with members, it’ll be useful to share relevant tips in numerous formats and provide plenty of recurring opportunities to learn about it.

Monitor Emerging Analytics Trends and Tech

Healthcare technology innovations are constantly evolving as software adapts to the growing amount of health data generated each year. Members depend on your association to share new developments that can impact their workflows, such as:

To demonstrate your association’s commitment to providing the most up-to-date insights into healthcare trends, consider hosting a recurring workshop or ongoing webinar series that presents new insights each week. This can also serve as a sustainable fundraising tool for your association, since constant updates can incentivize membership renewals in addition to providing non-dues revenue if you charge fees for these sessions.

Differentiate Between Operational and Performance Insights

The tips you share with association members depend on their unique roles, data needs, and the types of data you’re discussing. Keep in mind that some data (like clinical notes and socioeconomic data) influence the way members serve their patient populations. Other data, such as hospital readmission rates or cost savings, are more directly tied to internal operations.

Let’s look at the difference between insights from operational data and performance data.

Operational Data Insights

Operational data provides insights that inform decision-making in members’ respective fields. This could include information like:

Train members to make the most of operational data by sharing systems for analyzing this information and drawing important insights. Depending on members’ data literacy levels, they may also benefit from high-level training, such as an introduction to third-party data or methodologies for extracting insights.

Performance Data Insights

Performance data helps organizations evaluate their effectiveness over time, offering visibility into areas for improvement. Think about this data the same way you’d assess the most popular items in your online store or which fundraiser raised the most money. Members will similarly measure their performance in the healthcare industry—they’ll just use different metrics, such as:

Analytics tools are also important for supporting members’ performance improvement efforts, but make sure that any tools you recommend can tap into market intelligence and benchmark data. This technology will help members compare their performance against other organizations in the industry and identify opportunities to do better.

Note that there may be some overlap between operational and performance-related metrics. For example, a patient’s readmission rate could indicate the potential need for a different treatment plan, but it could also contribute to insights into the quality of care delivered.

Data is a powerful asset in the healthcare industry, and your association’s members are likely looking for new ways to interact with it. Whether they’re starting from scratch and need an introductory overview of data analytics or want a community where they can constantly stay up-to-date on the latest data innovations, your association can deliver what they’re looking for and ensure they see their membership as valuable.

4 Elements of an Effective Elementary School Fundraiser

From field trips to libraries to sports equipment, fundraisers support a wide variety of programs that make your school a place where students can learn and thrive. However, experienced school fundraisers know that launching a successful fundraising campaign is easier said than done, and that just a few core elements can make all the difference.

To help your elementary school’s next fundraiser go off without a hitch, this guide will break down four essential components of a successful school fundraiser and how to implement them.

1. Clear Goals

When it comes to fundraising goals, you may think the answer is obvious: your school wants to raise money for its programs, of course. However, goals like this often lack clarity about what success looks like, which makes executing an organized fundraiser and gathering useful data from it a challenge.

OneCause’s guide to fundraising event planning suggests setting SMART goals, which are:

Once you have a clear goal, break it into a series of smaller, individual aims. These should be specific tasks, like “assemble a fundraising team” or “research fundraising software.” These help you stay on track and can make a large, challenging goal seem feasible.

2. Fundraising Ideas That Excite Students

If your fundraising idea aligns with students’ interests, you’ll have a far easier time attracting participants and volunteers. For instance, one popular fundraiser for elementary school students is hosting a Read-A-Thon.

Read-A-Thon’s guide to these fundraisers explains how they work and can inspire a love of reading in students. The guide also recommends the following tips to make your fundraiser a success:

Essentially, a Read-A-Thon succeeds as a fundraiser due to its accessibility, connection to activities students and families already support, and potential for prizes to increase motivation. When choosing a fundraising idea for your elementary school, consider your students and community’s interests.

3. Easy Participation

Elementary school fundraisers rely heavily on support from your community and school staff. However, teachers and families of young children lead busy lives, and it can be difficult to squeeze in more than a handful of hours a week to help your fundraiser.

Meet your community where they’re at by making your fundraiser as easy to participate in as possible. For example, to make planning your fundraiser easier on your volunteers, you might leverage pre-made templates and software with out-of-the-box functionality. While platforms with extensive customization can be useful, prioritizing solutions that promise speed and ease of use is just as valid.

Additionally, the more flexible your fundraiser is with how individuals participate, the more participants you’ll attract. For instance, you could host a hybrid fundraiser that allows individuals to join in at any time of day from the comfort of their homes. Or, to accommodate parents and guardians who work during the day, you might host events exclusively at night or on weekends.

4. Community Support

When your community comes together to support your fundraiser, your chances of success skyrocket. Attract and retain community support by:

Chances are, your school will develop a small group of dedicated supporters who run most fundraisers and a larger community of donors and volunteers who drop in and out based on their interest and availability. Ensure you go the extra mile to appreciate the individuals putting in the extra effort to make your fundraisers happen, while also continually marketing your fundraisers to the wider community to retain their support.

When it comes to putting together an effective elementary school fundraiser, nailing down the essentials should be your first priority. Set a goal you know your school can achieve, make participation as fun and easy as possible, and start reaching out to your community to make your next fundraiser a team effort.

How to Apply for Corporate In-Kind Donations

4 Key Types of Metrics Medical Organizations Should Track

Medical organizations must be improvement-oriented to provide exceptional clinical care and patient experiences. The key to making impactful improvements that make a difference for your operations is data and analytics.

Every business identifies and tracks key performance indicators (KPIs) to measure how successful they are. The insights they glean from these metrics tell them what they’re doing right and where they can improve.

By tracking the right metrics, you can make smarter operational decisions and ultimately deliver more effective patient care. Let’s examine the most important categories of metrics that medical organizations should track and why they matter.

Clinical Quality Metrics

Clinical quality metrics help you measure whether your medical organization provides excellent clinical care. Metrics you might track that fall into this category may include:

These metrics help medical organizations meet regulatory and accreditation requirements and make internal improvements in care delivery. By monitoring these trends, you can make targeted changes to your organization’s infrastructure and processes that reduce complications and provide better care.

Plus, these metrics are a great way to demonstrate your accountability to patients and stakeholders. As UpMetrics explains, strong impact reports are built around both quantitative and qualitative data, so your organization may also consider conducting patient interviews or sending surveys to receive their feedback.

Patient Experience and Satisfaction Metrics

While clinical care effectiveness is essential, patients’ feelings about their care are just as important. If a patient is treated successfully but has a terrible experience with your staff members, this can greatly damage their trust in your healthcare organization.

To measure patient experience, track the following metrics:

In addition to tracking these metrics, you can measure patient experience through patient surveys. One or two days after a patient visits your medical organization, send them a survey through email or text message with a mix of short answer and multiple-choice questions they can answer about their experience. Surveys help patients feel heard and respected while enabling you to make data-driven decisions that improve their overall experience.

Operational Efficiency Metrics

Running a smooth operation doesn’t just result in happier patients—it also makes life easier for your staff members. In a recent study, over 45% of physicians reported at least one symptom of burnout. As burnout leads to lower productivity and work dissatisfaction, lightening the workload on medical staff and boosting operational efficiency is key to providing a better workplace.

Operational metrics highlight inefficiencies that you can target for improvement. Here are a few examples:

When you monitor these metrics with a robust practice management software solution, you can make better decisions for resource allocation, staff time management, and patient flow. Look for a comprehensive solution with features that increase operational efficiency, such as appointment scheduling tools and functionalities for managing and cleansing your data.

Financial Metrics

Financial metrics help medical organizations manage their finances and resources effectively and plan strategically for future growth and expansion. These indicators reveal how well your organization generates revenue, manages costs, and sustains profitability:

Streamlining financial management and billing operations is often challenging, and many medical organizations don’t know where to begin. These metrics will give you a good starting point for optimizing your process.

For instance, if you’re running into issues with insurance billing, your solution may be to outsource this work to a medical billing service to free up your time to focus on other revenue leaks. Or, you may take PracticeSuite’s recommendation and invest in medical billing software that streamlines the process and makes it easier for your staff members to handle.

Tracking the right metrics helps your organization run more smoothly and empowers you to deliver high-quality care. Whether you’re just beginning your data analytics journey or looking to refine your approach, focusing on key indicators in each area can provide the clarity you need to drive meaningful change. Determine your current priorities, whether that’s hiring, finances, or patient care, and set metrics for them that you can assess to shape a stronger future strategy.

How to Prepare for a Nonprofit Audit: 4 Essential Steps

If your nonprofit is considering conducting an audit, you might feel intimidated or worried, especially if it’s your first time. However, audits are a crucial part of effectively managing your organization’s finances, ensuring proper governance, and maintaining transparency with stakeholders. And once you understand the process, it isn’t nearly as scary as it may seem!

Most nonprofits hire external professionals to conduct audits, but that doesn’t mean your team should contact the first auditor you find and leave everything in their hands. Rather, proper internal preparation helps ensure your audit is accurate, timely, and useful for shaping your organization’s financial practices going forward.

In this guide, we’ll walk through four steps your nonprofit should take to get ready for its audit and lay the foundation for receiving thorough, actionable results. Let’s dive in!

1. Decide What Type of Audit You Need to Conduct

While the term “audit” is most often used in financial contexts, not every nonprofit audit focuses on finances. Different types of audits serve different purposes, and the right one for your nonprofit depends on your unique needs, goals, and priorities.

According to Jitasa’s nonprofit audit guide, the most common audit categories are as follows:

For the purposes of this article, we’ll focus primarily on independent financial audits since they’re the most common type of nonprofit audit. They’re also the most likely type of audit to be required for your organization, whether because of a stipulation in your bylaws, a federal or state government regulation, or a request from the funder of a grant you’re pursuing.

2. Lay out Your Auditing Timeline

The entire independent financial audit process takes several months to complete. If you have a deadline to submit your audit report to a grantmaker or government agency, note that date and work backward to figure out when you need to begin, building in some wiggle room to ensure you finish in time.

Here is a quick breakdown of the phases of the audit process and how long each one typically takes:

If your nonprofit doesn’t have an external deadline for your audit, try to conduct it and begin implementing the recommendations before completing your annual tax return. This way, you can let the IRS know that you’re actively improving your processes, and your team won’t have to work on two major financial projects at the same time.

The Form 990 filing deadline is the 15th day of the fifth month after the end of your nonprofit’s fiscal year (May 15 for organizations whose fiscal year follows the calendar year). You can extend the due date by up to six months if needed to conduct your audit—you’ll just have to file Form 8868 and get approval from the IRS to make the extension official.

3. Select a Nonprofit Auditor

Choosing your auditor typically takes longer than any other step in the independent auditing process. It’s important to select an individual or firm that can meet your needs and goals while working within your budget and timeline.

Here is a basic overview of how to find the right auditor for your nonprofit:

Just like with hiring financial team members for your organization, look for auditors who specialize in working with nonprofits. When searching online, use keywords like “nonprofit auditing firms near me” or “nonprofit auditors in [city name]” to narrow your results. Additionally, make sure their past clients include nonprofits of approximately the same size as yours to ensure they’re familiar with similar financial situations.

4. Organize Your Financial Records & Reports

After signing your contract and scheduling your audit, your auditor will send over a Provided by Client (PBC) list. This list details all of the documents they’ll need to complete their review, which can range from your fiscal policy handbook to financial statements to board meeting minutes. Compile these resources in a digital folder that you can share with your auditor for easy access.

However, pulling together everything on the PBC list is only part of the audit prep equation. You also have to clean up your accounting system—not only to help your auditor find the information they need in it, but also to demonstrate that you’re practicing good financial data hygiene, which the auditor will be looking for as they assess your procedures.

Before your audit, make sure to:

If you need help with these tasks, your bookkeeper or accountant can help you identify and resolve any issues in your accounting system before the audit begins and pull any reports you might still need for your PBC folder.

Even if you prepare thoroughly for your audit, your report might not be perfect, which is completely fine! Remember that your auditor isn’t just there to check boxes. They can be a valuable partner in helping your organization develop sustainable practices for long-term financial success.

When you get your report, take some time to review the recommendations with your team and determine the best ways to incorporate them into your financial management activities. Then, hopefully, your next audit can go even more smoothly!

How to Embed Philanthropy into Your Onboarding Process

70% of new hires can tell within the first week whether or not their new job is the right fit for them. The onboarding period is their first impression of your business, and it’s critical to their long-term success that they get off to a good start.

Your corporate social responsibility (CSR) program and philanthropic efforts are important facets of your overall employee engagement strategy, so why not incorporate them into your onboarding process and introduce new hires right away? Highlighting philanthropy during onboarding will make a great first impression during that critical period and improve the likelihood that they remain engaged and satisfied with their role.

Read on to learn more about intentionally embedding your philanthropy into your onboarding schedule to engage new employees.

Include your corporate philanthropy goals in their first-week information

Highlighting philanthropy during onboarding has two important outcomes. First, you demonstrate your business’s resolve and prove that your CSR work is not just lip service, and second, you give new employees the chance to get involved as soon as possible. As employees attend new-hire meetings and gain access to different software suites, make sure that your philanthropy program is included as mission-critical—not an afterthought.

In your onboarding schedule, set a dedicated time for a human resources staff member or CSR specialist to sit down with new hires and explain how your business’s philanthropy strategy works. You might include:

By including philanthropy in your new hire’s educational meetings, you demonstrate how firmly integrated it is into how your business is run. This is good for your new hire—allowing them to see your business’s values from the first day—as well as good for you, because philanthropic programs like workplace giving increase staff engagement and retention.

Your business’s software stack likely includes project management tools, communication options, HR software, and many others. If you leverage CSR software to manage your philanthropy programs, make sure to incorporate it into your onboarding training, too. If you don’t, consider investing! According to Uncommon Giving’s CSR software guide, these platforms help you engage employees, increase trust, and improve your brand’s reputation.

Encourage a volunteer day with a mentor in their first month

Once your new hire has been introduced to your business’s philanthropic goals, it’s time to give them the opportunity to engage in a more hands-on fashion. Your organization’s corporate volunteerism program provides the perfect way to showcase your values in action, while giving them a break from the office or computer during the stressful first-month period.

The first month of their tenure is important for learning your processes and getting to know their coworkers, so it can be valuable on multiple levels to encourage them to take a volunteer day early on. First, it shows that your company really does want its employees to use those days. Second, it provides a great opportunity for them to connect with a more senior staffer, whether that’s an assigned mentor, their manager, or just someone who cares about the same cause that they do. If your team is geographically dispersed, it can also be a helpful way to encourage them to make an in-person connection with someone who is located nearby.

This opportunity will also show your new hire how your corporate giving culture works in action. Don’t forget to tell them about any additional resources, like volunteer grants, that their nonprofit of choice might be eligible for after their day out!

Highlight your corporate philanthropy priorities regularly

In their first week, new hires learn about your corporate philanthropy programs. In their first month, they participate in a hands-on way. But what about the rest of their first year?

Instead of relying on them remembering everything that was covered in their orientation, create regular checkpoints and reminders to share philanthropic opportunities with your whole staff. This might look like:

Keeping your corporate philanthropy efforts front and center throughout the year will build your organization’s culture of giving, keep employees engaged, and continue to support the communities and nonprofits that your philanthropy serves.

With these tips, you can improve your bottom line and boost employee retention by embedding your corporate philanthropy directly into your onboarding process. If you remain consistent and focus on what resonates most with your employees, you’ll see participation continue to grow.