Nonprofit Investment Policy – Nonprofit Catalog

A nonprofit investment policy is the first step your organization should take before investing its reserve money. Creating a comprehensive investment plan will provide a clear roadmap and create continuity between your teams, ensuring that everyone’s on the same page about how to grow your funds.

If you’re creating a new investment policy or want to overhaul your existing document, we’ll make sure you understand the basic building blocks first!

What Is a Nonprofit Investment Policy?

A nonprofit investment policy is a document that outlines how an organization can invest the funds it raises responsibly. Think of it as a roadmap for your investment portfolio, guiding you toward smarter and more ethical financial management. It specifies the risks you’re willing to take, delegates responsibilities, and establishes investment objectives and guidelines.

An investment policy is not a set-it-and-forget-it type of document. Rather, you’ll need to regularly revisit it, making sure it continues to reflect your nonprofit’s priorities and needs year after year.

Why Do You Need a Nonprofit Investment Policy?

Just as there are several components to investing your reserve funds, there are also several reasons why you should invest them. For one, charitable giving is on the rise and increased an incredible 4.2% last year, according to fundraising research. Now more than ever, your nonprofit needs to curate strategies for making the most of those funds. That way, you’ll be in great shape to save what you need to take your mission to the next level.

More specifically, Infinite Giving’s guide to nonprofit investing outlines three primary reasons why nonprofits should invest their reserves and create a foolproof policy to guide their investments.

A solid nonprofit investment policy can help you:

- Save for the long term. Your reserves may be actively losing value if they’re sitting in a simple money market, CD, or savings account. Having an investment account along with a strong policy can allow you to grow your rainy-day funds. In other words, you don’t have to spend the money right away and won’t have to worry about inflation impacting your revenue. Then, when you do need to tap into these funds, they’ll be right there waiting for you.

- Build your nonprofit’s assets. Maybe you have a large project, like a capital campaign or a new program, that needs financial backing. Growing your reserves is a smart way to increase your spending power.

- Secure large gifts and grants. Grants Plus’ guide to grant management explains that “funders want and need to ensure that the grants they award will actually be put to their intended uses, create sustainable changes, and follow their stipulated requirements.” In other words, grantmakers and major donors want to make sure your nonprofit is a responsible steward of money. A strong investment plan can indicate that your organization’s financial standing is in good health and that you have a solid strategy for achieving your mission. Plus, an investment account will make it easier for you to accept large non-cash donations, like stocks, endowments, and cryptocurrency.

As you can see, there are multiple reasons why nonprofits should create an investment policy and open an investment account. Sound financial management practices can ultimately empower you to pursue your mission more effectively over the long run.

The Core Components of Nonprofit Investment Policies

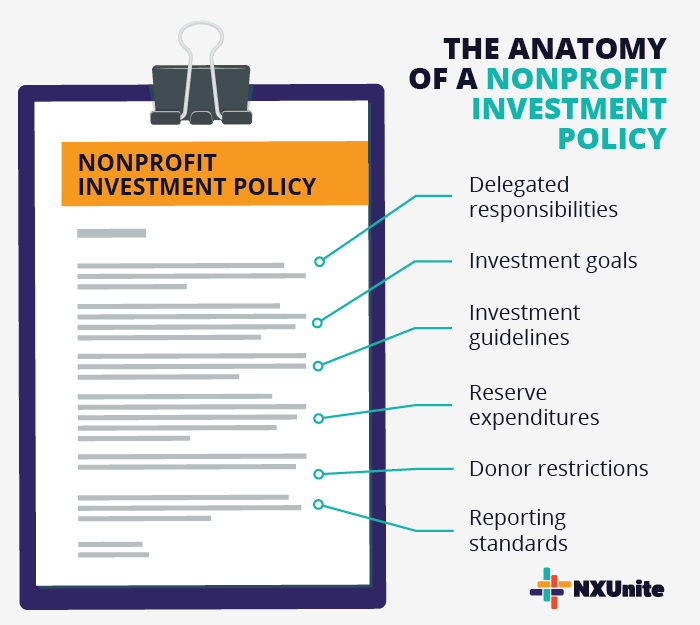

As we mentioned, creating an official policy is vital before you actually start investing your funds. Note that your specific approach to creating your investment policy can vary based on your timeline, risk tolerance, and current assets. However, there are several components that any nonprofit investment policy should have, including:

- Delegated responsibilities. List the specific roles, responsibilities, and limitations of anyone responsible for overseeing and handling your investment portfolio. This might pertain to your executive director, board of directors, oversight committee, and other stakeholders.

- Goals. Clearly define your investment portfolio’s objectives, including factors like potential risk allowed.

- Guidelines for investing. Cover which types of investment vehicles are allowed, as well as which ones are prohibited. You’ll also want to include target percentages for each type.

- Reserve expenditures. Add guidelines for how your nonprofit reserve funds can be spent, reasons why funds can be withdrawn, and how much can be withdrawn.

- Donor restrictions. Include a statement expressing that the investment committee agrees to any stipulations donors give regarding how their donations can be invested.

- Reporting standards. Define the metrics and frequency at which your board members will measure performance.

When developing or updating a nonprofit investment policy, it’s also important to understand the legal framework that governs how charitable funds must be managed. The Uniform Prudent Management of Institutional Funds Act (UPMIFA) establishes standards for fiduciary oversight, spending policies, and investment decision-making for nonprofit organizations. Nonprofits should review UPMIFA’s core principles and how they directly inform investment policy design, donor restrictions, and long-term stewardship responsibilities.

A lot goes into creating an investment policy for your nonprofit. Fitting these puzzle pieces together will give you a solid foundation for moving forward. Just make sure to treat your policy as a living document that you regularly revisit and update based on organizational changes.

Additional Resources

Nonprofit Catalog – Read up on more nonprofit essentials by exploring our Nonprofit Catalog.

How to Accept Stock Donations: The Ultimate Nonprofit Guide – Thinking of accepting stock donations to strengthen your sources of revenue? Check out this guide to learn how to accept stock donations and why it’s worthwhile.

Nonprofit Fundraising Training: FAQs and 8 Top Resources – Improve your financial literacy and strengthen your fundraising strategies with these training tips and suggestions!